menu start: Wed May 21 03:39:49 CEST 2025

menu end: Wed May 21 03:39:49 CEST 2025

menu start: Wed May 21 03:39:49 CEST 2025

menu end: Wed May 21 03:39:49 CEST 2025

Piergiorgio Carapella, Alessandro Fontana, Andrea Montanino, Ciro Rapacciuolo

A vivid debate is developing in Italy about a proposal by the ruling political parties for the creation of a new financial instrument, informally called “MiniBOT”, recalling the name of Italian short term sovereign bonds. The official document approved by the Parliament does not clarify either the details of the instrument, or its goals. Based on what we know about it, it could be somehow a hybrid between money and a government bond.

Building on the possible characteristics of MiniBOTs emerged in the recent debate, the Centro Studi Confindustria has detected a long list of critical issues related to its application, given the current conditions of the Italian economy. Below, we briefly discuss each of these issues. As a whole, our assessment concludes that it is very unlikely that this financial instrument could be beneficial for firms as the proponents assume, and/or for the country as a whole. On the contrary, MiniBOTs can undermine the credibility of the country at a time when the European partners are questioning whether Italy is compliant with common fiscal rules on public debt.

The concept of MiniBOT appears in the “Government contract” between the Five Stars Movement and the Lega, signed in May 2018. In the intention of the proponents, MiniBOTs are small Euro denominated securities, with face value, no expiration date and that carry no interest. The “Government contract”, however, lacks details that are critical in evaluating the instrument.

On May 28th 2019, the Italian Parliament approved a non-binding motion that commits the Government to speed up the payments of the arrears of the public sector to privately owned businesses (liabilities of trade credits) with a number of different methods and instruments. Among them, the motion includes MiniBOTs, but it does not provide any further detail on their characteristics.

According to Bank of Italy estimates, the amount of firms’ trade credits towards public administrations was 53 billion Euros at the end of 2018, 3.0 per cent of GDP, decreasing by 0.3 percentage points of GDP with respect to the previous year and equal to around half of the estimate for 2012 (Figure A).

According to the data of the Minister of Economy and Finance, the time it takes to pay trade debts has been reduced by 17 days in the last two years; on average, sub-national governments have paid 2 days before the deadline fixed by the Directive 2011/7/EU (on combating late payments in commercial transactions). The improvement is due to the actions taken in the last years and proposed by Confindustria.

This does not mean that public administrations are good payers. In fact, Italy still shows the highest stock of trade debts compared to other European countries (Figure B). Furthermore, in the South of Italy, some local entities in Basilicata, Abruzzo and Sicily still show significant delays.

Even if some issues are still pending, currently there is not an emergency as in 2012. At that time, the situation was characterized by low liquidity available in Italian firms, a deep credit crunch, and a profound economic recession. The amount of firms’ trade credits towards public administrations peaked at 91 billion Euros, exacerbating the liquidity constraints.

Nowadays, Italian firms have succeeded in increasing the liquidity generated internally and, on average, they do not suffer a liquidity crisis. Bank lending has started again to decrease, but to a lesser extent. Theeconomy is stagnating, but it is not in a recession.

Since it would not have the status of legal tender, the MiniBOT would be a less liquid instrument than paper money and coins. A creditor, in fact, would not be required to accept a payment in MiniBOT. Thus, as a medium of exchange, a MiniBOT would not be like money.

The public administration would probably be the only sector of the economy to always accept MiniBOTs held by an Italian firm, even if it is unclear at this stage how local public administration would be forced to accept MiniBOTs. Private entities, mainly other firms, could instead accept a MiniBOT on a voluntary basis, and likely there would not be any legal binding rule.

The main function of a MiniBOT would be to act as a store of value, like a traditional public bond. However, differently from a BTP, it would not pay an interest, like money. Thus, the liquidity-interest combination of a MiniBOT would be worse than that of both money and traditional public bonds.

In addition to the lack of some of the functions of money, there are two other reasons why a MiniBOT would never represent a parallel currency.

First, the total amount of MiniBOTs issued would be limited by the value of the stock of commercial debts of the Italian public sector, which is currently around 53 billion Euros, much lower than the value of Euro money circulating today in the country (202 billion).

Second, the Bank of Italy has already made it clear that MiniBOTs are, in any case, in contrast to the European rules. Therefore, Italian firms could not go to the Italian Central Bank to have euro coins and paper money in exchange for a MiniBOT. The risk, for a private firm, is to hold forever a MiniBOT without ending up with cash.

Yes, without any doubt. Following the European System of Accounts (ESA 2010), trade credits are not to be intended as general government debt in Maastricht Excessive Deficit Procedure terms, due to their temporary nature. Instead, MiniBOTs are governments bonds, with no expiring date. Thus, the stock of government debt would raise accordingly.

According to Bank of Italy estimates, if MiniBOTs were used to pay (all) outstanding trade credits, government debt to GDP ratio would raise by 2.4 percentage points. Given that Italy’s debt to GDP ratio is already one of the largest in the Eurozone, an increase by this amount would likely have negative and lasting effects on interest rates. Moreover, Italy is already on the verge of a debt-based excessive deficit procedure (EDP). Thus, an increase by 2.4 points of the debt-GDP ratio could escalate the confrontation with the EU institutions and could even lead to sanctions, never imposed so far, once the EDP is open. Nothing is said on whether MiniBOTs would be a permanent instrument or a one-off solution to reduce the stock of trade credits.

Firms typically have debts with the public sector due to the different kinds of taxes they pay during the year: on average, a typical firm makes around 14 payments to the Revenue Service due to the transfer of collected VAT, social contributions for their employees, income taxes, etc. In principle, MiniBOTs could allow for compensation of such debts with any credit due to goods and services provided to a public administration, either at national or sub-national level, such as hospitals, schools, municipalities.

However, while most of fiscal debts are due to the central administration, trade debts are owned mainly by the local administration (around 85 per cent). Thus, if the emissions and the payments with MiniBOT are reserved to central government, they cannot be a solution to late payments.

If, instead, the emissions of MiniBOTs is reserved to the central government, but all branches of the public administration (including sub-national governments) can use them to pay their debts, a complex system to manage the intergovernmental financial relations must be put in place. This task is not easy because of the high number of public bodies (around 20.000) and the difficulty to manage omitted or late payments among entities. Thus MiniBOTs could result in even more delayed payments due to the bureaucratic difficulties in implementing such instruments, with respect to an already established procedure like that of 2013.

Assuming that the public sector is able to set up such a system, it means that the compensation of credits and debts of firms among different public entities would be possible. Thus, there is no need to introduce MiniBOTs: in fact, a firm could ask for compensation of a debt with a national fiscal agency, using a credit with a Municipality; the national fiscal agency would then have its credit paid by the Municipality. Italy needs Information Technology, not MiniBOTs. Lastly, if deemed necessary, to speed up the payments of arrears, the same mechanism used in 2013 could be implemented: central government issues an amount of standard sovereign bonds and transfers liquidity to the sub-national governments that own the trade debt.

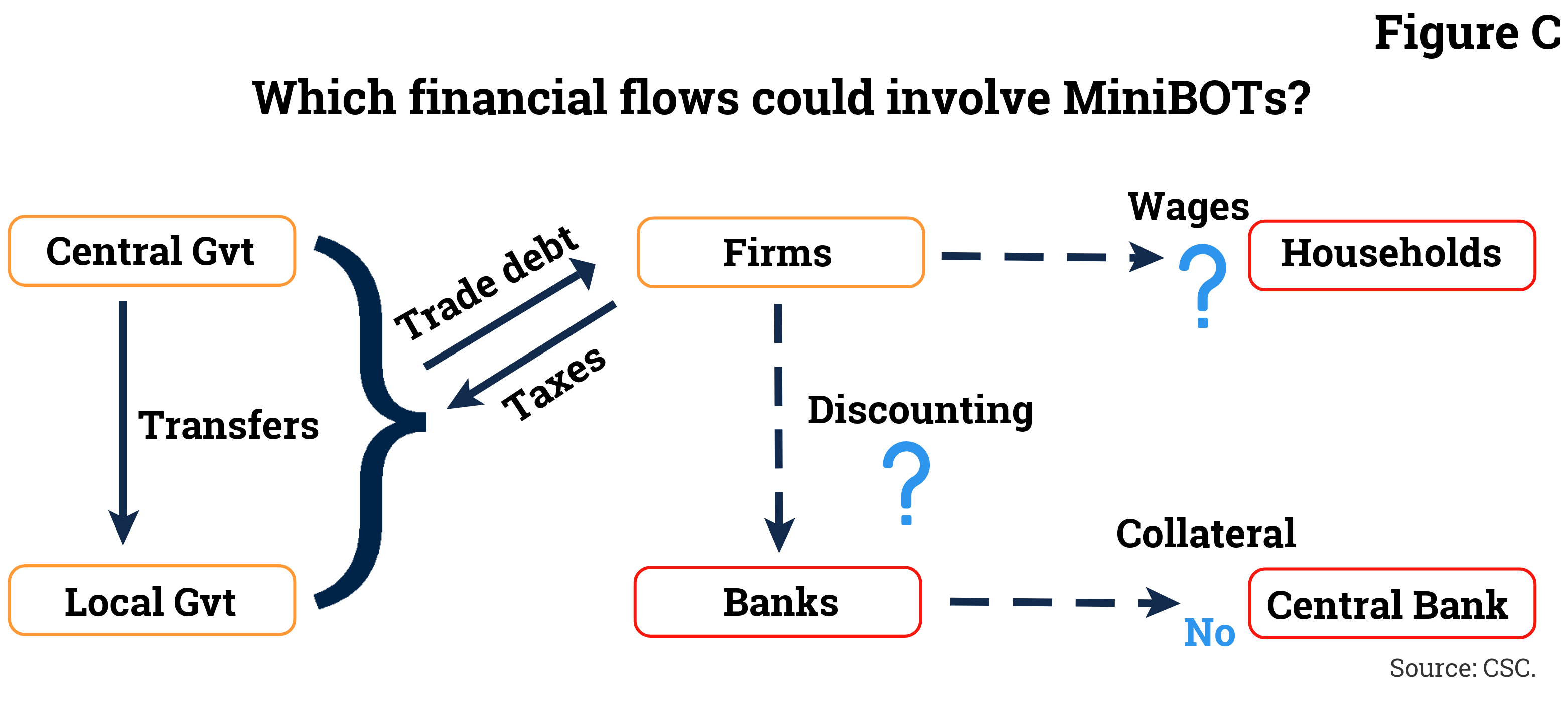

The basic use of a MiniBOT could be the payment of taxes, at its face value (Figure C). In the transactions between private entities (a firm and its supplier), instead, the MiniBOT would probably be accepted only with a discount on its nominal value.

Moreover, the development of a well-functioning secondary market for MiniBOTs (between firms) could not be taken for granted: the determination of the discount rate, for example, would be an issue. If this market does not develop properly, the liquidity and value of the instrument would be reduced further.

As a result, Italian firms would receive an instrument with less value than money for the goods and services sold to the public sector: their revenues would be reduced with respect to a cash payment.

An Italian bank could, on a voluntary basis, accept and discount a MiniBOT held by an Italian firm, paying cash for it and holding the bond in its assets.

Banks already discount trade debts and there is an established market for this. In particular, banks evaluate the likelihood of being paid by the debtor and the timing to get paid. On the basis of this evaluation, banks set the discount rate. This evaluation should not be required for MiniBOTs because the issuer is always the central government. However, such a market does not exist and should be developed from scratch, like with any other financial instruments.

In addition, differently from a BTP, a MiniBOT does not carry an interest rate and has no expiration date in which to recover for sure the face value. Thus, the bank could have no incentive to hold MiniBOTs, apart from the possibility of paying its taxes with them, gaining on the discount rate.

Finally, Italian banks could have a problem with the European banking supervisor, during the periodical revision of the quality of their assets and their ratio to capital. ECB has already declared that a circulation of the MiniBOTs as a form of parallel currency in Italy would be illegal.

If MiniBOTs were to be treated - in the ECB bank surveillance - as government bonds, then Italian banks that accept them would add to their holdings of domestic sovereign bonds. In Europe there is an ongoing and long-lasting debate on possible revisions of banks’ prudential rules just for this kind of bonds: some countries would like to go in the direction of penalizing domestic sovereign bond holdings by banks. If this would be done imposing limits in each country and not by incentivizing cross-border diversification of banks’ bond holdings, it would have the strongly negative effect of suddenly curbing the demand for domestic sovereign bonds in an individual country, lowering their price and increasing their yields. This would be particularly damaging in a country, like Italy, with a large public debt. Our country, in fact, has been struggling in the last years to avoid such penalizing limits. Thus, adding MiniBOTs in the banks’ balance sheets, in presence of this already complicated issue, would only worsen the position of Italy in the debate.

In 2012, the payment of the stock of old commercial debts by Italian public administrations was clearly a one-off measure, with a highly positive potential impact because it relaxed the binding constraint represented by low liquidity in firms at that time.

In 2019, instead, the proposed MiniBOT looks more like a structural instrument, not a one-off shock measure. Moreover, today the payment of public arrears has less potential for stimulating growth. In fact, on average there is not a binding constraint given by liquidity in the private sector, even if a significant fraction of firms is still struggling with it (Figure D). Our assessment is that the impulse to growth for the entire economy, if any, would be very small this time.

The first risk for Italy would be to breach the current set of European rules by starting a parallel circulation of a mean of payment in the country that is not present anywhere else in Europe. If it starts circulating on a secondary market, it will become similar to a parallel currency: this would be illegal and would create additional uncertainty, domestically and abroad, on the willingness of Italy to respect common rules and act as a member of the Eurozone. In addition, international investors have been highly concerned by the high stock of Italian public debt for many years: any measure raising the level of debt will be scrutinized and is likely to have a short-term negative impact on sovereign spreads.

Higher interest rates, in turn, would weigh on public deficit and on economic prospects in Italy, penalizing credit and the competitiveness of firms.

To our knowledge, there is not a single example in recent years of a financial instrument like MiniBOTs. The State of California issued something similar in 2009, when it experienced a temporary budget shortfall. California issued 2.4 billion dollars, equal to 0.1 per cent of its GDP, in IOUs (I Owe You, basically registered warrants) to pay public employees, contractors and everyone who owned the right to a tax reimbursement. However, unlike MiniBOTs, they carried a 3.75 per cent interest rate, with a maturity of three months. It was a sort of a bridge to allow the legislators to approve the budget law. They were implemented to face a massive shortage of liquidity in the public sector, which is not the current Italian scenario, and were not foreseen as a permanent measure.

The experience was not a success: after the first week banks started not to accept IOUs. Only after a round of spending review and tax raise ruled by the State, financial institutions agreed to accept again IOUs. Furthermore, the issuing of IOUs led the agency Fitch to cut the credit rating of the State of California by two notches.

Italy will likely face an excessive deficit procedure for not respecting the public debt criterion, and it is already paying a high risk premium on its sovereign debt. It is dangerous to add tensions and risks at this juncture talking about MiniBOTs, when instead the country needs a credible medium term strategy to reduce the interest rate spread and increase the economic growth rate.

Furthermore, the problem with public arrears and firm liquidity has already gradually improved in the last years. In fact, the stock of public trade debts is decreasing, as well as the time to be paid, and Italian firms are not suffering a liquidity crisis today. Thus, the introduction of MiniBOTs risks also to prove useless, in addition to being dangerous.

Of course much remains to be done, since Italy still has the largest stock of public trade debts in Europe. But, what Italy needs are reforms to improve the effectiveness of the public administration, not a questionable new financial instrument.

Sulla base di un ampio campione di bilanci di imprese industriali italiane, risulta che la redditività operativa è praticamente tornata sui livelli pre-crisi, ma c’è minore disponibilità di credito bancario dopo la crisi finanziaria degli scorsi anni.

Alla vigilia delle elezioni per il Parlamento europeo e il successivo rinnovo della Commissione, qual è il sentimento degli italiani verso le istituzioni europee?

La manifattura italiana occupa la settima posizione al mondo per valore aggiunto. Eppure è diffusa, l’idea che essa sia da tempo affetta da un forte deficit di competitività.