Stefano Di Colli

Share on

- The Mont Blanc Tunnel constitutes a strategic infrastructure for the Aosta Valley and the North-West economic system. It represents an essential channel for exports to France (more than 20% of regional exports), for imports of French goods and for tourist flows from France and French-speaking Switzerland in particular.

- Infrastructural alternatives (Frejus, Gran San Bernardo) do not fully compensate for the interruption of the direct connection between the Aosta Valley and France, generating higher logistical costs, longer transport times and reduced competitiveness for businesses and tour operators.

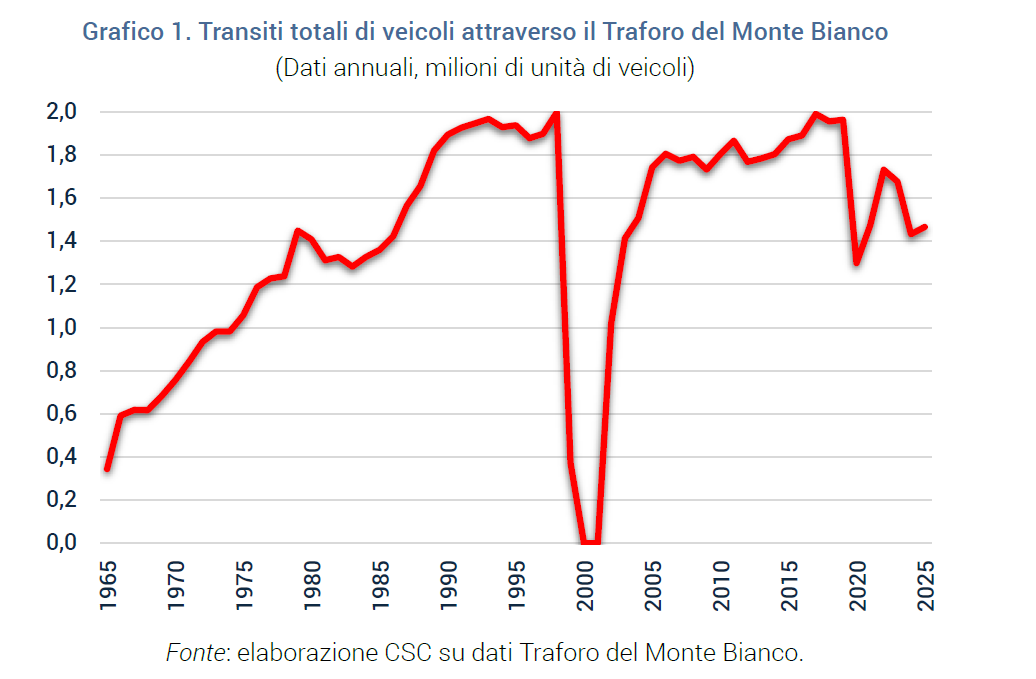

- In 2019, the last pre-pandemic year without closures, about 1.96 million transits were recorded (1.3 million light vehicles and 649,000 heavy goods vehicles). The technical closures of 2023-2025 (up to 15 consecutive weeks) showed how even temporary interruptions produce a significant reduction in flows.

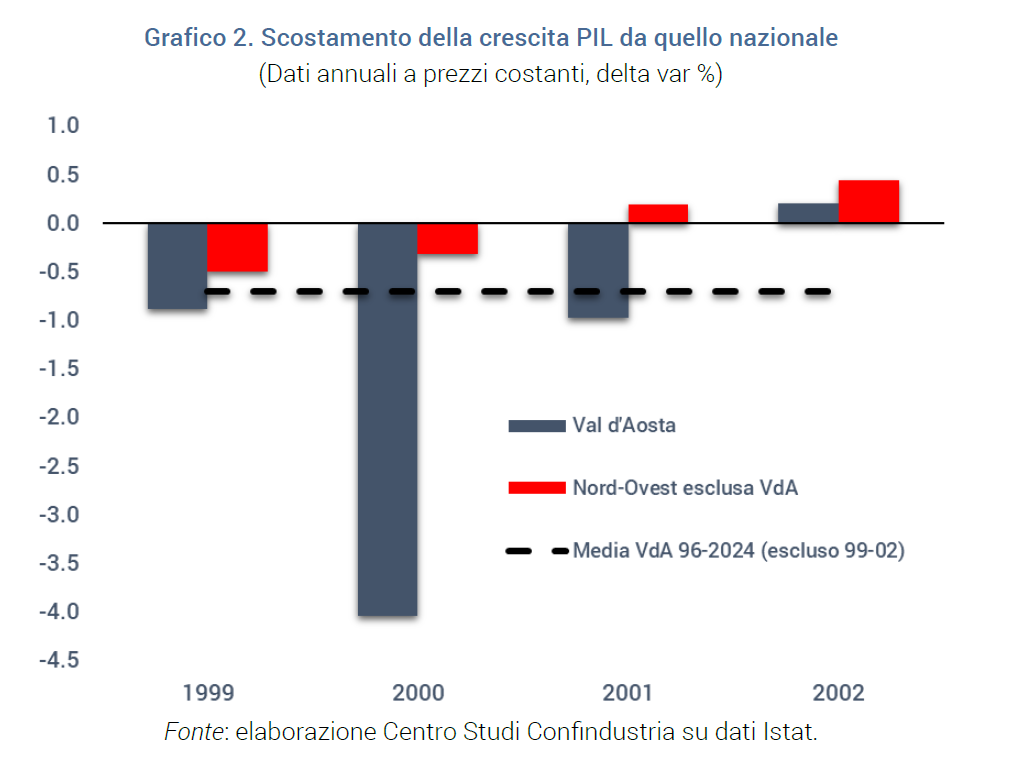

- The historical experience of the 1999-2002 closure, following the tunnel fire, shows significant and persistent economic effects: over the three-year period 1999-2001, the regional GDP recorded a cumulative deviation of -5.1% compared to the national trend. The estimated loss attributable to the closure is approximately -2.3% of regional GDP.

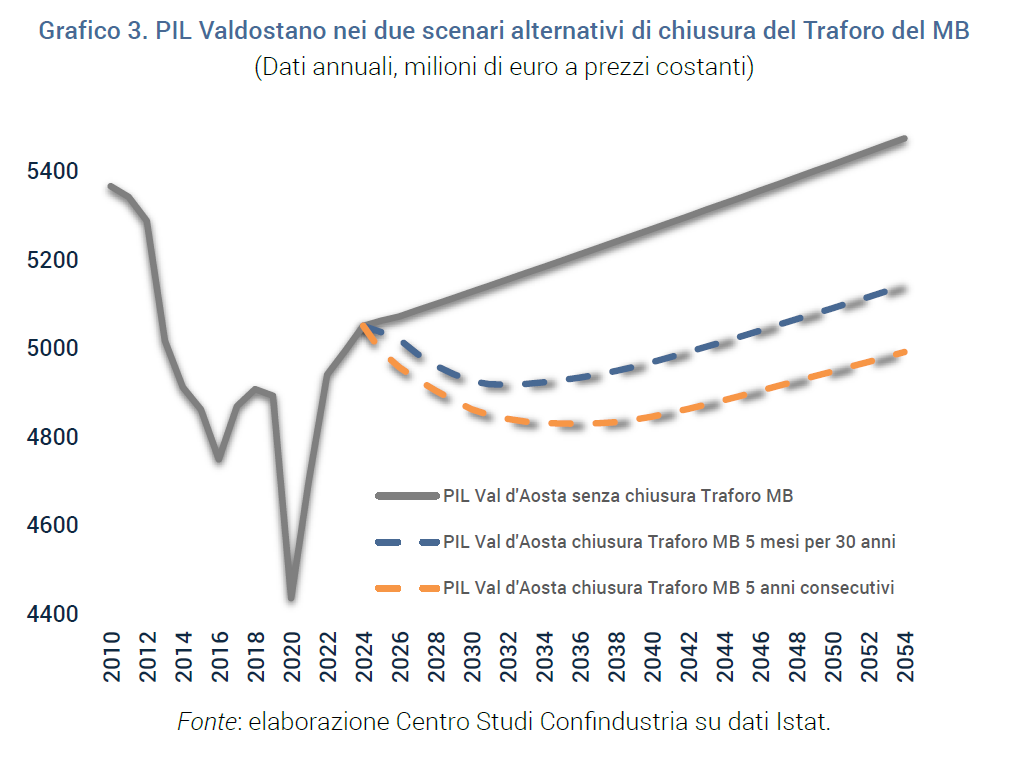

- Two alternative scenarios were formulated: one under the assumption of a closure of 5 months per year for 30 years, the other of a closure of 5 consecutive years.

- Econometric simulations for the period 2025-2054 estimate that a closure of 5 months per year for 30 years would result in a cumulative loss of approximately -6.1% of regional GDP to 2054, with a total impact of EUR 7.8 billion and an average annual reduction of EUR 262 million.

- The scenario of continuous closure for 5 years would produce even more intense and lasting effects, with an estimated cumulative loss of -8.8% of regional GDP to 2054, totalling EUR 11.1 billion. Evidence suggests that prolonged interruptions generate not only temporary effects, but long-term recomposition effects on motorway routes.

Executive summary

The connection between Italy and France through the Mont Blanc Tunnel represents a crucial infrastructure for the economy of the Aosta Valley, the Italian North-West and, more generally, for trade flows between Italy and France. Significant portions of the region's exports (in 2024, about EUR 168.6 million, equal to 20.5% of the region's exports to the world, almost exclusively manufacturing), key tourist flows - particularly from France and French-speaking Switzerland - and a significant portion of goods imported from France (EUR 39.8 million, 8% of the total) pass through the tunnel. In 2019, the last pre-pandemic year with no closures, there were almost 2 million crossings, including cars, motorbikes, trucks and coaches. Even short interruptions or partial closures in recent years have already resulted in significant drops in transits.

The historical analysis clearly demonstrates the region's economic vulnerability to prolonged interruptions of the Tunnel. Between 1999 and 2002, following the fire that caused its closure, Valle d'Aosta experienced a significant slowdown in economic growth: the regional GDP was 5.1% lower than the national trend, with an estimated loss attributable to the closure of about -2.3% of GDP. The closure caused a very persistent diversion of traffic flows to other Alpine passes and a drop in French and foreign tourist presences, with negative consequences on the local economy.

In order to estimate the impact of a future closure, an econometric model was estimated in which Valle d'Aosta's regional GDP is explained as a function of national GDP and Tunnel transits. The model made it possible to formulate a basic forecast scenario (baseline) in the future horizon 2025-2054 under the hypothesis that the Tunnel would no longer be closed during the period and that the national economy would grow annually in line with the average dynamic of the last 30 years, and two different alternative scenarios, one of Tunnel closure for 5 months a year for 30 years, the other of continuous closure for 5 continuous years. Considering that in the years between 2023 and 2025 the Tunnel was closed for about 3.5 months (15 weeks) each year, stricter assumptions are adopted to take into account possible slowdowns in the works. In addition, the total months of closure in scenario 1) are more numerous than in scenario 2) (150 versus 60) to take into account the annual assembly and dismantling time of the construction sites. Scenario 2) also takes into account the effect of relocation to other transport routes, which would gradually penalise traffic in the years following the reopening.

The economic impact of the Tunnel closure on the Valle d'Aosta economy is however estimated as the difference between the real Valle d'Aosta GDP in the two alternative scenarios and in the baseline scenario, with the following results:

- Scenario 1 - Closure of 5 months per year for 30 years: The estimated cumulative impact on regional GDP is -6.1% to 2054 compared to the baseline, with a total loss of about EUR 7.8 billion and an average annual reduction of EUR 262 million.

- Scenario 2 - Continuous closure for 5 years: The effects would be more intense in the first years and permanent in the long term due to the structural reallocation of traffic flows to other crossings. The estimated cumulative impact is -8.8% of regional GDP to 2054, with an overall loss of about €11.1 billion and an average annual reduction of €371 million.

This evidence confirms that the Mont Blanc Tunnel is a real factor in regional competitiveness. Prolonged interruptions compromise not only commercial and tourist traffic, but also overall economic growth, with structural effects that are difficult to reverse.

The importance of the Mont Blanc Tunnel

The major communication route between Italy and France that passes through the Mont Blanc Tunnel is a crucial infrastructure for the economy of the autonomous region of Valle d'Aosta and for the country. In this Focus, two alternative estimates of the possible economic impact of a Mont Blanc closure are formulated. In the first scenario a closure of 5 months per year for 30 years is assumed, in the second a closure for 5 consecutive years.

The importance of the Mont Blanc Tunnel. An important part of the export flow of Italian goods to France passes through the Tunnel, not only goods from the region but also goods from the entire North-West and the rest of Italy. Moreover, the Mont Blanc Tunnel is the traditional access route for French and Swiss tourists (the Suisse Romande) to the Aosta Valley and neighbouring regions. These two flows contribute significantly to the regional economy, i.e. to its added value. In addition, part of the transport of French goods imported from Italy also passes through the Tunnel, which is important for Valle d'Aosta and Italian consumers and businesses.

To illustrate the importance of these road, and thus economic, flows, one should look at the figures for 2018-2019, the pre-pandemic years and the last years in which the Tunnel was never closed. After that, tourism remained compressed for a long time (at least until 2022), as did exports to some extent. The transits of cars and motorbikes through Mont Blanc in 2019 amounted to 1.3 million, those of lorries and coaches 649,000, for a total of 1.96 million passages (see Chart 1). In the peak years of the pandemic (2020 and 2021), total transits fell to 1.30 (2020) and 1.48 million (2021). Thereafter, traffic has not returned to pre-pandemic levels. The Tunnel has also recently been closed for technical reasons: in 2023 it was closed for 9 weeks between October and December, in 2024 and in 2025 it was closed for 15 consecutive weeks between September and December for vault repairs.

The value of Valle d'Aosta's exports to France amounted to 168.6 million euro in 2024 (around 20.5% of the region's exports to the world), almost exclusively manufacturing (98.8%), while imports amounted to 39.8 million (8.0% of the total). The presence of foreign tourists in Valle d'Aosta in 2019 amounted to 1.5 million . The total added value of the Aosta Valley in 2019 was 4.2 billion euros. A prolonged closure of the Mont Blanc Tunnel therefore generates negative effects for the regional economy, due to the lack of exports, the non-arrival of tourists, and the scarcity of French goods. Alternative roads to cross the Alps do exist, but they are not designed to connect the region with France (the Frejus between Piedmont and France, the Gran San Bernardo between the Aosta Valley and Switzerland), so the routes for goods and people, in the event of closure, become longer and more expensive.

Tunnel closures in history

The economic effect for the Valle d'Aosta region of the closure of the Mont Blanc Tunnel can first of all be assessed on the basis of historical experience, observing the dynamics of regional GDP, added value and exports in the period between 1999 and 2002, when the Tunnel was closed due to a serious fire, which occurred on 24 March 1999, and reopened on 9 March 2002.

The total number of transits in the immediately preceding year, 1998, was 1.998 million vehicles, of which 1.193 million were cars and motorbikes and 805 thousand coaches and trucks. The closure of the Tunnel resulted in an estimated loss of transits of about 1.705 million vehicles (1.011 million cars and motorbikes and 694 thousand motor coaches and trucks) during the nine months of closure in 1999, and about 7.430 million (of which 3.779 million cars and motorbikes and 3.651 million motor coaches and trucks) over the entire period of almost three years from 1999 to 2002 (CSC estimates based on Mont Blanc Tunnel data).

The closure of the Mont Blanc Tunnel following the accident in 1999 resulted in vehicle traffic between Italy and France being diverted to the Frejus tunnel, the Great St Bernard tunnel and, during the non-winter period, the Little St Bernard Pass. The presence of tonnage limits for the passage through the Great St. Bernard Pass imposed the transit through the Frejus of lorries, precluding any possibility of compensating, within the region, for the loss of heavy vehicle traffic through the Mont Blanc tunnel. The increase in transits through the Great St Bernard Pass was limited to 219,000 vehicles (+41.7%) in 2019 and 56,000 in 2000 (+7.5%). In Valle d'Aosta, transit journeys through the tunnels in 1999 fell by 47.3% for light vehicles and 71.8% for heavy vehicles (-55.7% the total) compared with 1998, and in 2000 by a further 17.0% for light vehicles and 69.0% for heavy vehicles (-28.4% the total), with appreciable repercussions on the Region's tax revenues, as well as on the activities of businesses (Bank of Italy, 2000).

A relevant fact is that the closure of the Tunnel between March 1999 and March 2002 resulted in a structural loss of transits compared to the long-term trend, even after the reopening, observable until more recent years. In 2019, total transits through the Mont Blanc Tunnel, which had grown by an average of 4.0% per year between 1966 and 1998, and then by an average of 2.2% per year between 2003 and 2019, were still 34,000 fewer than in 1998. This gap with respect to the long-term trend can be estimated at about one million passages per year, mainly of heavy vehicles (over 800,000), a portion of which initially limited to 20%, and gradually decreasing over the years, were relocated to the Great St. Bernard.

Moreover, in 1999 the number of foreign tourists in Valle d'Aosta fell by 6.6% and arrivals by 10.2%, of which about 10 thousand fewer arrivals from France (-20.3%) and 18 thousand fewer presences of French tourists (-17.9%). This drop, which was substantially confirmed in 2000 when the arrivals of foreign tourists fell by a further 0.2%, was attributed to the unfavourable weather conditions of 1999 and the flooding in 2000, but was mainly due to the closure of the Mont Blanc tunnel, which in several cases led to the exclusion of the region from the routes of groups travelling through Europe (Banca d'Italia 1999, 2000). On the other hand, the increase in the average length of stay observed in 1999 and 2000 can be attributed to the decrease in short-term stays, linked to passages through the Tunnel (Bank of Italy 1999, 2000).

During the periods of closure for technical reasons, the Tunnel experienced a further decline in transits: as mentioned above, when it was closed for 9 weeks between October and December in 2023, transits fell to 1.68 million from 1.73 million (after the pandemic, transits did not return to pre-pandemic levels of almost 2 million). In 2024 and 2025, on the other hand, it was closed for 15 consecutive weeks between September and December for vault refurbishment works and transits dropped further to 1.43 million in 2024 and 1.47 million in 2025.

The Mont Blanc Tunnel and the Aosta Valley economy. The overall correlation between Valle d'Aosta's and the North-West's growth in added value over the 1996-2020 period is 0.79, quite high (0.75 compared to the aggregate trend in Italy, only slightly lower). The added value of the Valle d'Aosta region in the two-year period 1999-2001 grew by 0.7%, i.e. much less than the Italian average (+5.9%), the North-West (+5.7%) and all the other regions taken individually: the second worst, Molise, saw its added value grow by 4.0% in the same period. To this should be added that in 2000, Valle d'Aosta was the only Italian region to record a fall in value added (-0.2%, compared to a national average growth of 3.9%, and 3.5% in the Northwest). This drop does not seem to be entirely attributable to the flooding in October 2000.

In a broader historical perspective, the trend of regional value added in Valle d'Aosta tends to be rather similar to that of the Northwest and Piedmont, with some exceptions. The most relevant are in 1997, precisely in 2000 due to the closure of the Tunnel, in 2004 (end of funds for post-flood reconstruction in 2000), in 2013 and in 2016 (delayed effect of the sovereign funds crisis and subsequent recession). Among these, the negative variance observed in 2000 was 3.7% compared to the North-West (and 4.1% compared to Italy as a whole), the second highest when considering the entire 1995-2024 period. The same phenomenon can also be observed when examining the regional gross domestic product: in the 1999-2001 period, the cumulative deviation between Valle d'Aosta's GDP and Italy's is -5.1%, the worst recorded for the entire peninsula. It should be noted that the second worst (Basilicata) was more than 2 percentage points lower (-2.9%) and that that of the Northwest (excluding Valle d'Aosta) was -0.1% (Graph 2). This anomaly seems to be due to the effects of a specific event that occurred at the regional level during that period, namely the Tunnel closure.

A measure of the cost, in terms of added value, of the closure of the Mont Blanc Tunnel in 1999-2000 can be obtained as a deviation from economic growth consistent with that of Italy as a whole (to take account of the fact that the closure of the Tunnel would also have an impact on the other regions of the North-West). By estimating a simple regression between these two variables, one can obtain the “theoretical” Valdostan growth in the absence of regional anomalous events, to be then corrected for the effect of the flood by adapting the estimates of Carrera et al. (2015) . The deviation of the actual figure from the predicted one based on the macroeconomic determinants of Valdostan GDP thus represents an estimate of the effect of the Tunnel closure, equal to -2.3% of regional GDP over the three-year period 1999-2001.

The estimated cost of closure in the 30-year period 2025-2054. Estimating what the effect of a closure would be today must take into account how transit conditions have changed over time, partly as a result of the tragic fire in 1999, and partly due to extraordinary circumstances, such as the recessions of the last 30 years, the pandemic and the administrative restrictions this has entailed. As mentioned earlier, about 1 million annual transits from France have moved to other routes.

In order to take into account alternative hypotheses on the trend of transits subject to different scenarios of Tunnel closure, an annual model was estimated which explains the trend of Valdostan real GDP based on the dynamics of national real GDP and the dynamics of transits in the Mont Blanc Tunnel. This model was used to elaborate a baseline forecast under the assumption that the Tunnel operates regularly, and to simulate two alternative scenarios: the first assumes that Italian GDP and transits grow at a rate equal to the average rate from 1995 to 2024, and two alternative scenarios under the assumptions that 1) transits decrease due to a closure of 5 months per year for 30 years, 2) the Tunnel remains closed for 5 consecutive years.

In 2023-2025, the Tunnel was closed for about 3.5 months (15 weeks) each year. Stricter assumptions are adopted in this analysis to take into account possible slowdowns in the work. In addition, the overall months of closure in scenario 1) are more numerous than in scenario 2) (150 versus 60) to take into account the annual assembly and dismantling times of the construction sites. On the other hand, scenario 2) takes into account the effect of shifting to other transport routes which would gradually penalise transit traffic even in the years following reopening.

The cumulative economic impact to 2054 of a closure of five months per year has been estimated at about -6.1% of regional GDP in real terms, i.e. about 333 million less real GDP in 2054 compared to the baseline and 262 million less on average per year between 2025 and 2054 (Alternative Scenario 1, see the blue dashed curve in Chart 3). The cumulative loss, calculated as the sum of annual GDP losses over the entire 2025-2054 horizon, would be 6.3% of GDP and EUR 7.8 billion.

The consequences of a closure of five consecutive years would be much worse in the early years (Alternative Scenario 2, see the red dashed curve in Chart 3), and would also be affected by a delayed effect of shifting transport flows to other transit channels (as observed after the 1999-2001 closure). The cumulative impact to 2054 under this assumption was estimated at -8.8% of regional GDP in real terms, i.e. about 483 million less real GDP per year in 2054 and an average of 371 million less per year between 2025 and 2054. The cumulative loss, calculated as the sum of annual GDP losses over the entire 2025-2054 horizon, would be 9.2% of GDP and EUR 11.1 billion. It should be noted that both scenarios are calculated from 2024 (last available regional GDP figure), when the Valdostan economy was affected by the two years of Tunnel closure by 9 weeks in 2023 and 15 weeks in 2024, respectively.