February 2026

January 2026

December 2025

October 2025

A global pandemic, lockdown, disruption of international supply chains, war in Europe, skyrocketing gas prices, high inflation, restrictive monetary policies (especially in advanced countries). All this has only happened in the last three years and the high degree of uncertainty persists, because there is unlikely to be a return to the business as usual pre-pandemic. However, the world economy may be heading for a gradual recovery after the shocks of the pandemic and the Russian invasion of Ukraine. China is recovering strongly following the reopening of its economy and disruptions along supply chains are easing, while imbalances in energy and some food and other commodity markets caused by the war are receding. At the same time, massive synchronised monetary tightening by most central banks should begin to have the desired effect of bringing price dynamics closer to targets.

The monetary austerity of advanced countries may become a risk factor for some emerging economies, especially those characterised by structural vulnerabilities, such as imbalances in public accounts and/or current account. Yield spreads may, in fact, translate into capital flight and sudden exchange rate depreciations. Some countries are already showing symptoms of fragility, e.g. Argentina, Iran and Turkey, where the respective currencies have depreciated significantly.

The Russian invasion of Ukraine could produce damage to international trade far beyond the already serious damage caused by the sanctions imposed on and by Russia and the impossibility of trading in the areas affected by the war operations. In fact, a new geopolitical fragmentation is being erected in Europe that, even if hostilities end, seems destined to remain for a long time due to the depth of the wounds caused by the conflict. The war has also exacerbated tensions between the US and China as the latter has compensated for the closure of trade between the Western bloc and Russia; tensions could then escalate if the already tense situation in Taiwan escalates.

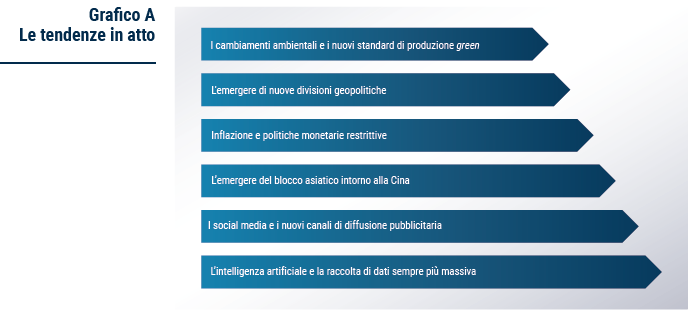

Online sales, the increasingly massive storage of information on digital platforms, the reduction of people's physical journeys, and the juxtaposition of social and mass media are some of the phenomena that have been growing in intensity and importance for more than 25 years, and even more so with the pandemic, posing unprecedented challenges to production and sales models. First and foremost, The speed of adaptation required of companies as a resilience factor to continue operating in international markets becomes crucial. Technological change has also led to the emergence of giants and web giants that operate on a global scale with monopolistic rents that are difficult to undermine, at least in the immediate future, by other economic operators (Chart A).

In the 'beautiful and well-made' (BBF) sectors during the three-year period 2018-2020, Italy saw its shares decline due to a composition effect of the export basket that instead rewarded Germany, Japan and the Netherlands during the period considered. However, the drop in shares was contained by a competitiveness and basket balancing effect towards more important geographical destinations. The competitive improvement was mainly expressed in the ability to charge higher prices, e.g. in comparison to China, which, on the other hand, continues to experience a price ballast effect on the valorisation of its exports.

Italy exports 99% of the more than 5,000 products traded worldwide, and with the same proportion the almost 1,400 final consumer products. Italy is second only to China for the variety of products exported in the BBF sector.

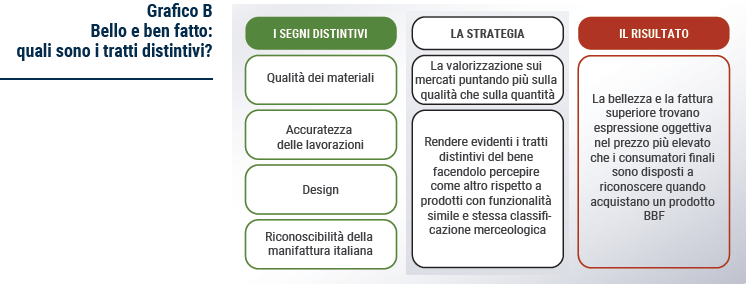

What defends BBF goods from fierce price competition is the distinctive qualitative element, which places them in a different market environment than other goods formally classified in the same product categories. In fact, these are products that in many cases make a market in their own right, being placed in areas where a small number of competitors operate, mostly located in advanced countries with cost structures similar to those in Italy. In this sense, the BBF goods exported from Italy (characterised by their orientation towards an evolved consumer, attention to quality and the transfer of an emotional value) compete with those produced by more developed competitors, operating in niches protected by countries with a lower level of costs.

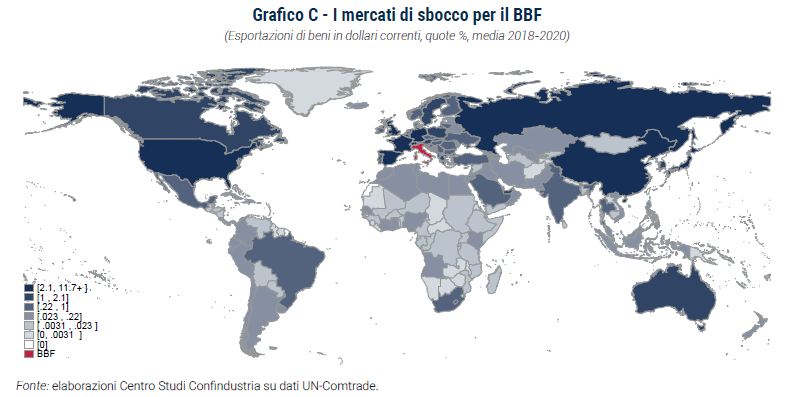

The geographical alignment between the investment and trade network provides an important indication of the level of exposure to external shocks. The geographical distribution of the export shares of the BBF segments, together with the share of inbound and outbound corporate holdings, shows a robust country network in terms of both economic stability and international relations. In 2022, EU countries alone accounted for 46% of BBF exports and 37.5% of foreign-controlled Italian companies. The USA also plays a very important role in the BBF sectors, counting for 13.3% of exports and 18.7% of holdings in Italian companies controlled from abroad. Among the emerging countries, China is especially important as a destination for investments by Italian companies in the form of shareholdings in Chinese companies.

The ease of recognising Italian character as a characteristic of a product and appreciating it has established itself over time all over the world, which is why consumers are willing to recognise a higher value to a good made in Italy rather than that produced by a competitorand consequently to pay more for it. The BBF and its distinctive features are the flag of Italianness in the world (Chart B). This product category encompasses all those goods that represent Italian excellence in terms of design, attention to detail, quality of materials and workmanship. These are high quality products that are distributed in all production sectors, and find their highest expression in the productions most closely linked to taste and creativity. From this point of view, the BBF is the most easily recognisable expression of the made in Italytaking up the most characteristic features of the heritage cultural heritage of Italy, its traditions, landscapes and works of art, contributing to the image of a productive Italy. In this sense, the 'beautiful and well-made' not only represents an important share of Italian exports worldwide, but also acts as a driving force for all Italian exports, having not only an economic but also an intangible value.

The BBF represents a significant part of Italy's total exports and cuts across all major sectors from the made in Italyalbeit more markedly in the '3F' sectors of Fashion, Food, Furniture. Italian excellence is mainly directed towards advanced markets, which together absorb around 104 billion euro. On the other hand, the amount of excellence exported to emerging countries amounts to more than 19 billion Euros, which, due to their dynamism (both demographically and economically), and despite their still limited weight, offer relatively greater growth margins. Graph C offers at a glance the geographical distribution of Italian BBF in the world.

The analysis contained in the Report makes it possible to obtain a measure of the potential of Italian exports within the BBF, against which to evaluate the margin of improvement of the positions acquired to date. The potential is calculated by assessing the possible expansion of current market shares compared to those of competitors who, in terms of production cost structure and quality of exported products, have similar characteristics to those of Italy. More than three quarters of the potential lies in advanced countries (74 billion euro) and the remainder in emerging countries (22 billion euro).

The advanced countries represent larger markets and demand BBF goods more intensively (their per capita income is higher), Italy being historically more linked to the sphere of western economies. The mature economies of these countries, however, have demographic and economic trends that are not very dynamic and growth is achieved by trying to erode market shares from competitors or, alternatively, by not losing any: in large-volume contexts, even low growth rates can represent a great gain and a strong expansion for companies, especially if they are small or medium-sized. Emerging countries, on the other hand, have a smaller share of world trade, but have been expanding for two decades now and have faster growth prospects than advanced countries. However, many emerging markets have critical issues related to both economic stability and uncertainty about current geopolitical trends.

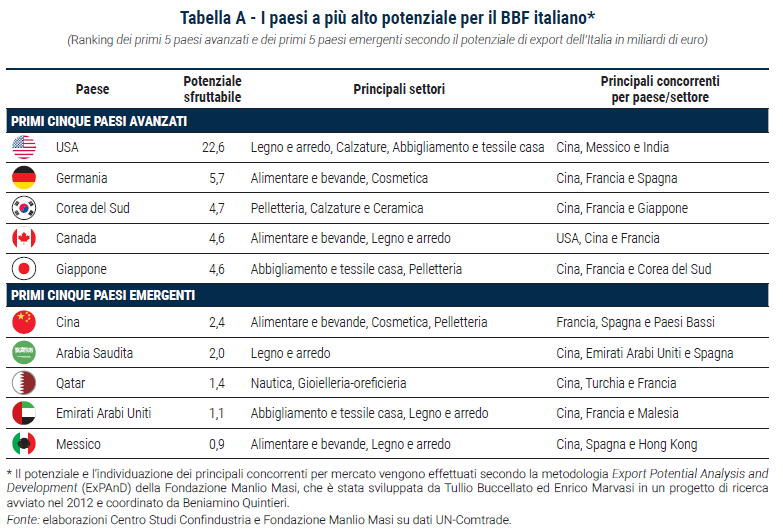

The actual realisation of potential comes through commercial penetration in those countries and sectors where growth margins are highest. Each geographic outlet market presents peculiarities both in terms of the sectors with the highest potential and in terms of competition. A synthetic picture is illustrated in Table A, which shows, for the top five advanced markets and the top five emerging markets in terms of potential, the sectors that count most and Italy's main competitors in these markets.

Driving exports to advanced countries is the strong sharing of tastes and standards that reflect a substantial affinity of cultural contexts. These are also the main countries with which Italy maintains economic, political and strategic relations, and with which geo-economic ties are particularly intertwined. The most important countries are the United States (22.6 billion), Germany (5.7 billion) and South Korea (4.7 billion). The sectors that export the most are those related to the '3Fs', with China and France as the most important competitors.

Among the emerging economies, the main markets are China (EUR 2.4 billion), Saudi Arabia (2.0) and Qatar (1.4). In addition to the '3F' sectors, Nautica also appears here, which is particularly flourishing in countries with a high spending class of population. Even in emerging countries, the two main competitor of Italian companies are France and China.

Russia is a market that would rank second in terms of exploitable potential among the emerging markets, but following the invasion of Ukraine, it is inconceivable that trade could intensify.

In general, it is interesting to note that recent trends are shifting the centre of gravity of potential more towards advanced economies than emerging countries. In particular, China's potential has shrunk slightly compared to EDV 2021, as the intensity of Chinese trade with economic partners similar to Italy, whose exports could find an alternative in the made in Italy. These trends could be further reinforced by ongoing geopolitical tensions. On the other hand, among the emerging economies, the countries of the Arabian Peninsula, where the top of the BBF range is sold, occupy more and more space.

Italian exports of 'beautiful and well-made' goods have, in fact, found great dynamism and high growth rates to ASEAN countries. Although the impact of the health crisis significantly slowed down BBF sales to these countries, recording a loss of almost 25%, the post-pandemic recovery of BBF exports to these markets ensured a broad recovery of exports, which grew by an average of 32.2% per year between 2021 and 2022. The latter values meant that Italian BBF exports to ASEAN in 2022 would reach EUR 1.6 billion. It is to be expected that the growth in demand for BBF from these countries will continue to be sustained in the coming years, also considering the centrality of South-East Asia in the diversification strategies of international companies that are progressively targeting not only China.

Singapore remains the top ASEAN market for BBF exports, accounting for 35.3% of exports in the region. The city-state, characterised by one of the most affluent populations in the world with high spending power and international tastes, imported BBF goods worth about €562 million into its borders in 2022 alone. The demand for Italian products will also enjoy a tourist flow expected to grow strongly in 2023. Compared to past years, however, the country's export weight of BBF has been decreasing in favour of fast-growing destinations, including Malaysia and Thailand. The growth of exports to Malaysia - a country characterised by a large middle class with relatively high levels of disposable income - was mainly driven by the jewellery sector, where sales in 2022 amounted to more than EUR 90 million. Thailand, which relies on a particularly well-developed tourism sector, rising incomes and an increasing level of urbanisation, imported BBF goods worth EUR 336 million last year, mainly in the Leather Goods, Food & Beverages and Jewellery & Jewellery sectors.

In general, Italian products face less competition from the player Asian compared to Western ones, both in relation to total exports and to the BBF subset, which mitigates the competitive disadvantage resulting from the greater trade integration between the countries of the region. However, access to ASEAN markets by Italian firms often finds obstacles in tariff barriers. These, in the form of taxes ad valorem, increase the price of goods imported and traded in the areas under consideration. This is particularly true for BBF products, which are subject to duties that are usually higher than average for products imported from ASEAN countries, especially in Indonesia and Laos. A further obstacle to BBF exports to ASEAN is represented by non-tariff measures (NTMs), which entail not inconsiderable costs for Italian firms.

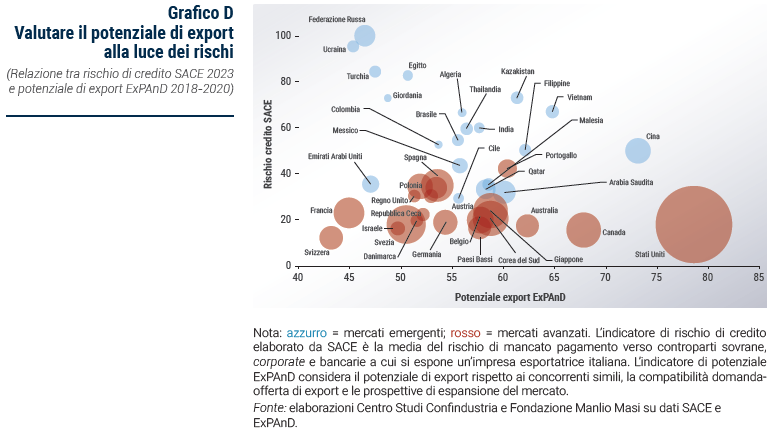

International tensions linked to the conflict in Ukraine, rising prices and restrictive monetary policies contributed to the deterioration of the global economic framework, which was still suffering from the negative effects of the pandemic crisis. The combination of these factors led to higher indebtedness for both the public and private sectors, which in turn induced a generalised deterioration in credit risk. To understand the implications, the analysis of potential is accompanied by an analysis of the risk posed by each market (Chart D). It is not surprising that Russia and Ukraine are ranked so high on the credit risk scale, being the two countries directly involved in the conflict. The advanced countries, which, moreover, are the most important destination for BBF exports, where the more structured economies are allowing for greater stability despite the difficulties, remain rather safe.

The recognition by the world's and Italy's highest institutions, clearly defined by theAgenda 2030 and theParis Agreementof the need for a reversal of the economic paradigm that places sustainable development at the centre, opens the door to a new way of doing business. In fact, it is no longer sufficient for companies to aim at maximising profit, but it is necessary for them to become aware of the impact of their choices on the environment and thus improve the management of resources (natural, financial and human) without ever exploiting them so intensively as to compromise the well-being of present and future generations. Basically, it will be, and already is, the task of companies to pursue value maximisation in the long run.

To gain new market share and secure the loyalty of today's consumers, the degree of sustainability of the products sold cannot be neglected. Indeed, the portion of consumers, almost 70%, who take sustainability into account in their purchasing choices is dominant. Moreover, it would be a serious mistake to consider this phenomenon as temporary, as this trend does not seem to have been challenged even by the most serious economic turmoil in recent years.

The integration of the three dimensions of sustainable development (environmental, social and economic) within the company's processes requires the adoption of strategies aimed at defining medium-term sustainability objectives and the path to achieve them, starting from one's own vocations and specificities and seeking to enhance what has already been done. The adoption of a virtuous path of integration of the Corporate Social Responsibility (CSR) requires companies to integrate their strategic sustainability objectives with their business plans and to assess their actual progress and improvement by relying on an adequate internal monitoring system, through reporting on their CSR performance. Their proper communication would allow the company to attract the interest of various categories of customers, especially investors and lenders, and would bring considerable benefits to the brand reputation.

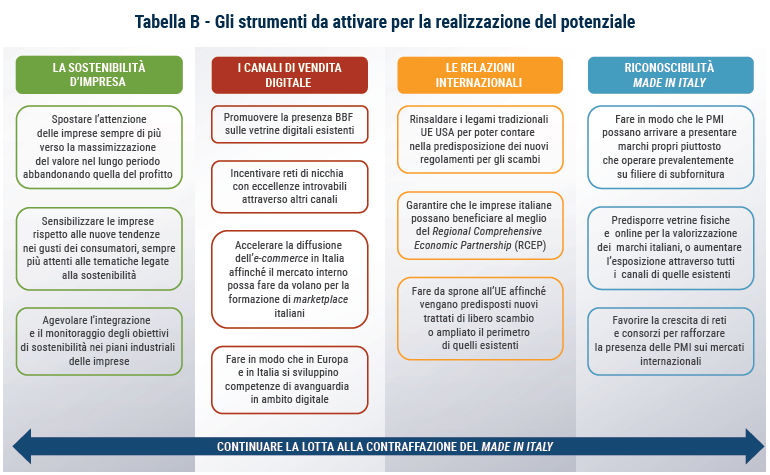

In an increasingly connected world where online trade continues to grow rapidly, strengthening digital sales channels, whether it means promoting the BBF's presence on existing channels or doing so on new ones, is vital. Not presiding over these 'virtual markets' would accumulate a competitive disadvantage that would be difficult, if not impossible, to overcome. Through these channels, but not only through them, it is also possible to promote the creation of brands for small and medium-sized Italian companies. The recognisability of the made in Italy could also be enhanced by encouraging the creation of networks and consortia of companies aimed at extracting more value from global value chains and aimed at overcoming the undersized nature of Italian entrepreneurship in many sectors.

The extraordinary performance of Italian exports around the world can also be attributed to the numerous trade agreements that Europe, and consequently Italy, has signed over the years. The promotion of new European treaties and the re-establishment of EU-US ties can contribute to the stabilisation of international relations that Italy cannot do without in the face of growing competition. The integration of markets facilitates trade, and Asia recently established the world's largest trading area, the Regional Comprehensive Economic Partnership (RCEP). Equally crucial for BBF export performance are the free trade agreements (Free Trade Agreements - FTAs) which, especially in ASEAN markets, help Italian companies to overcome tariff and non-tariff barriers. Finally, in countries with which there are no FTAs with the EU, it is important to pragmatically pursue dialogue at the bilateral level to overcome market access barriers and obstacles (Table B).

The quality of Italian products and their excellent reputation throughout the world makes them the object of imitation. The appeal to aesthetics made in Italy allows them to charge higher sales prices without reflecting the intrinsic value due to the poor quality of the materials and poor workmanship. According to an OECD report, the companies that most imitate BBF are mainly located in China, Turkey and Hong Kong. The high loss of market share due to counterfeiting makes its fight urgent. Italian products must then be protected against another equally damaging but legal phenomenon, in contrast to counterfeiting, namely theItalian sounding. This consists in evoking the idea of the quality of Italian products on labels and packaging through the use, without actually falling into illegal practices, of names, geographical references, images, colour combinations and the reproduction of brands similar to the originals. The consequences of these practices are particularly harmful and represent one of the greatest obstacles to the full unfolding of the potential of food made in Italy. Actions that can be taken to mitigate the problem range from strengthening the protection of geographical indications within free trade agreements to the use of more effective marketing campaigns that help brand recognition made in Italy.