Ciro Rapacciuolo

Share on

Italian GDP at a standstill. On foreign markets, there remain the two powerful brakes created by US duties and the weak dollar, which impact on Italian exports and which, together with uncertainty, have blocked GDP growth in Q3. For Q4, positive signs are the recovery of confidence, linked to a more attenuated uncertainty, the return of oil prices, and the growth of investments stimulated by the NRP. Industry weak, services better.

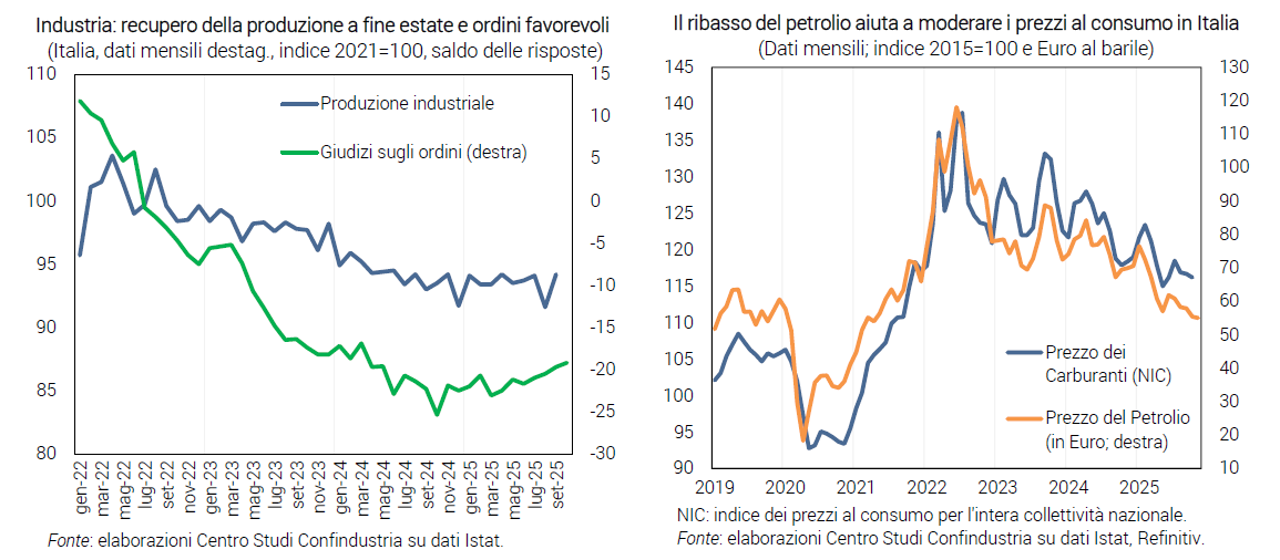

Food prices up, oil down. Food prices rose (+2.1%, meat +5.8%), more than core goods and services prices (+1.8%). The drop in oil prices ($64 per barrel in November), equal to the 2019 average, is driving down consumer fuel prices in Italy (-1.4% trend in October, -2.7% for petrol). The price of gas also fell slightly (EUR 31/MWh), but remains well above the values recorded before 2022. As a net result, total inflation is moderate (+1.2%).

The US rate cut continues. In the Eurozone, no further ECB rate cuts are expected, which have been stuck at 2.00% since June, and the cost of credit is stabilising (in Italy, 3.38% for companies in September). In the US, on the other hand, the Fed cut in October to 4.00%, the second consecutive move, and another cut is expected between December and January. The dollar, driven more by the outlook for the US economy than by rates, recovered a little against the euro: 1.155 in November, from a peak of 1.174 in September.

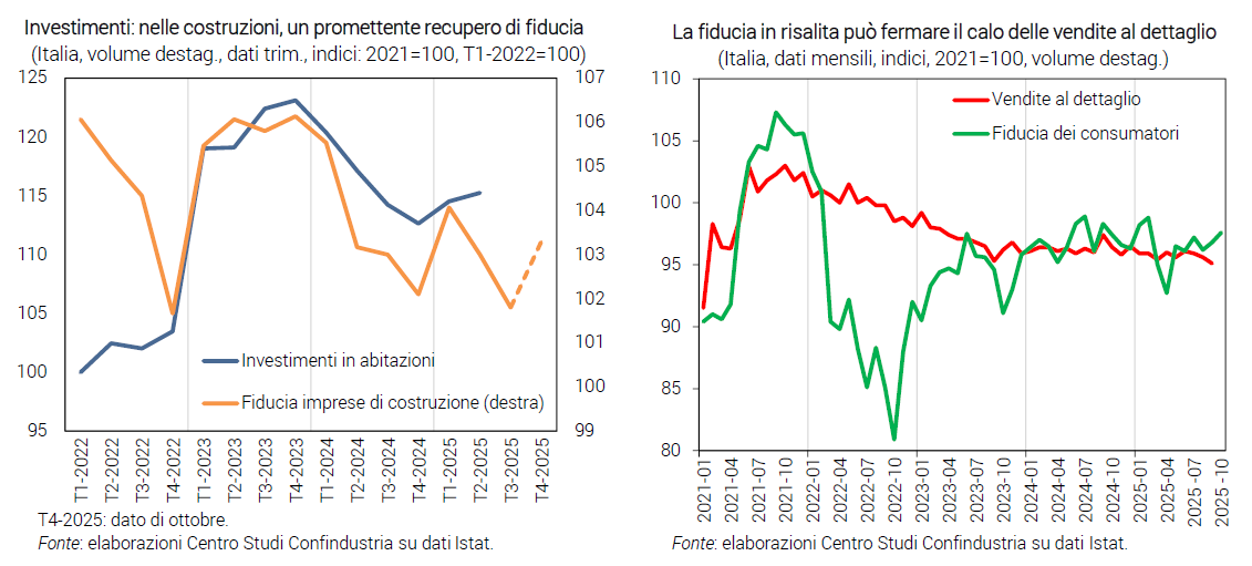

Investments grew in the second half of the year. The indicators confirm the positive phase of investments in plant and machinery: in October, the confidence of companies producing capital goods increased further (89.2 points), both in terms of expectations on orders and judgments on production. After the drop in the summer months, the confidence of construction companies improved: the less negative judgements on orders compensated for the drop in expectations on construction plans in the coming months.

Consumption: household confidence rises. In September, retail sales fell by -0.5% and the whole of Q3 closed down (-0.4%), most markedly for food (-0.9%). In October, car sales turned negative again, after a few encouraging months. Household confidence improved for the second month in a row (97.6 from 96.8) and this may be acting as a drag on the propensity to save. The number of employed persons rose again in September (+0.1% in Q3).

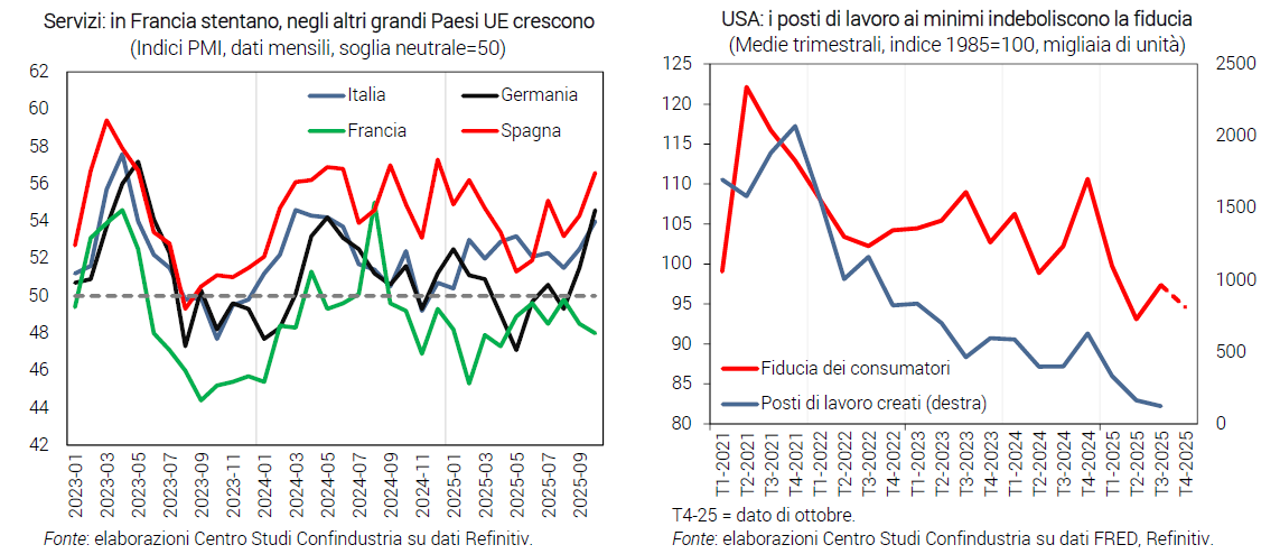

Services: almost all positive indicators. Tourism continues to grow at a moderate pace: +3.9% per year in August for foreigners' spending, at current prices. RTT (CSC-TeamSystem) estimates a full recovery of turnover in September, after the decline in August. In October, the HCOB-PMI indicates a stronger expansion in services (54.0 from 52.5). In contrast, business confidence in the sector falls again.

Industry: remains weak. After the slump in August, industrial production recovered in September (+2.8%), as suggested by the CSC survey and confirmed by RTT. However, the change in production in Q3 remains negative (-0.5%). In October, business confidence recovered, thanks to less unfavourable orders and better expectations, and the PMI almost reached the neutral threshold (49.9 from 49.0).

Slight recovery in exports. Italian trade in goods recovered in September: +2.6% in exports (after -2.5% in August), driven by the US market, especially in pharmaceuticals and other transport equipment. Recovery is also widespread in other destination markets (France, Spain, Poland, Japan, India, OPEC countries). The outlook, however, remains negative, according to foreign manufacturing orders in October. Weak European demand and the new US duties on medium and heavy-duty vehicles from 1 November are weighing heavily.

Eurozone: fragile growth. In September, industrial production recorded differentiated increases in the main countries (see Focus). In services, the PMI was positive in Germany as well as in Spain, but weak in France. In the area, in aggregate, confidence and employment expectations improved.

US: manufacturing and consumption weak. Pending an assessment of the economic effects of the longest shutdown in US history (42 days), the composite PMI in October improved to expansive levels (54.6). Manufacturing, on the other hand, presented a weak picture: the ISM and the Chicago PMI remained recessive, as did various territorial indicators of the FED. The low number of jobs created in Q3 seems to have adversely affected consumer confidence, which is declining.

China: industry slowdown. Chinese manufacturing expanded weakly, with the October PMI at 50.6 (from 51.2), which was confirmed by a slowdown in production (+4.9% from +6.5%). Exports shrank by 1.1% year-on-year, due to the sharp drop in sales to the US (-25.2%), not offset by other markets (EU +0.9% and Asia +11.0%). In the immediate term, the China-US agreement to ease trade restrictions may not have a significant effect on exports, due to the previous frontloading.

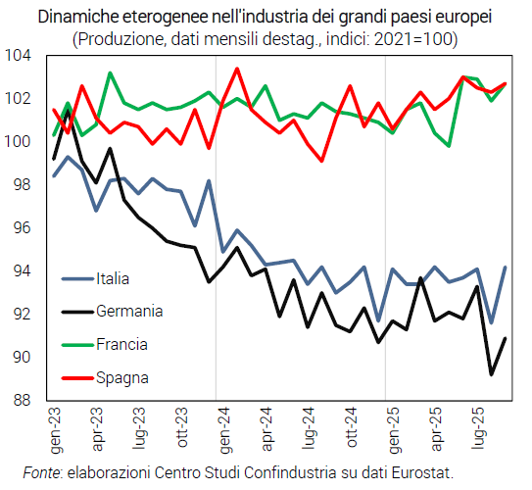

From 2023, wide gap between European industries

Industry better in Spain and France. Comparing the dynamics of industrial production in the main Eurozone economies, a strong heterogeneity emerges since 2023. Manufacturing in Germany and Italy showed a significant decline, while in France and Spain it shows a stable or moderate growth profile. In 2024, in particular, Germany and Italy recorded very negative results (respectively -4.6% and -4.0% on average per year), while Spain recorded a slightly positive change (+0.4%) and France held up, with a change in output of zero.

In 2025, the gap remains. In the first nine months of 2025, industrial production still declined, more moderately, in both Germany (-1.5% in annual terms) and Italy (-0.9%). Conversely, in Spain there is a strengthening of manufacturing growth (+1.0%). And industry in France remains in the middle, with zero dynamics again this year. Looking at the most recent data, after a negative August everywhere, September saw a recovery in all countries: partial in Germany (+1.9% after -4.4%), almost full in France (+0.8% after -1.0%), more than full in Spain (+0.4% after -0.2%). Thus, on average in Q3, Germany and Italy still recorded a decline (-0.8% and -0.5%), in France and Spain growth continued.

Improving economy. Indicators suggest the continuation of the improved performance of Spanish industry in the coming months. Manufacturing PMIs tracked well on easing in Germany and Italy this year; in October, they are just below neutral (49.6 and 49.9); for Spain, they continue to suggest expansion (52.1). Manufacturing business confidence is also recovering in Germany, indicating easing of the decline; it remains stable, at higher levels, in Spain and France.

Several reasons for the gaps. The lower cost of energy in Spain favours its industry. Conversely, the crisis in the automotive sector affects Germany more, where it is the heart of industry; the devalued dollar and US duties also penalise German goods exports more. In France, the recent political instability, together with fragile public accounts, has led to higher rates that dampen economic activity, including industrial activity.

More moderate industrial prices in Italy. In 2025, Italian industrial companies are increasing their sales prices moderately (+0.8% in the first 9 months, in annual terms), after the downward adjustment in 2024 of a similar magnitude (-0.8%): therefore, industrial prices today remain close to the peaks touched two years ago, which were reached with the marked rises of 2021-2022 on the back of the anomalous increase in energy prices. The trend of industrial prices in Italy has historically been similar to that of other major European countries, only recently a misalignment has been observed: on the one hand, the dynamics in Germany, where prices rose more than in Italy until 2023 and recorded a further increase in 2024-2025 (+1.1% in September from the peak in March 2023); on the other hand, in Italy, France and Spain, prices have remained more or less stable over the last two years, fluctuating around the peaks, with a slightly more pronounced drop in Italy (-0.7% from the peak). In particular, Italian industrial companies in the downstream sectors, those of consumer goods, showed a lower price profile along the 2022 upswing and even more so in the following years: this reflected the weaker demand in Italy. In the capital goods and intermediate goods sectors, on the other hand, Italian price dynamics are close to those in other countries. In Germany, the three types of industries show the strongest price dynamics: this may have contributed to the worse volume performance.

Future prospects also differ. For Italy, the consumption of goods will slowly improve, the export of goods will remain weak, if not falling due to duties and the dollar. Much will depend on investment dynamics: but in the short term, there are no expectations of significant growth in production. In Germany, on the other hand, the huge planned spending on infrastructure and defence will have a positive impact from 2026, reducing the gaps. For French industry, managing instability will be crucial. In Spain, competitiveness factors (such as energy) will not disappear in the short term, which means that better industrial dynamics are still expected.