Ciro Rapacciuolo

Share on

Complicated situation. The weak dollar against the euro, partly due to Fed rate cuts, continues to hold back Italian exports in the fourth quarter, along with US tariffs. Household confidence is faltering again, and with it consumer expectations. Industry is still struggling. On the positive side are investments (largely thanks to the PNRR), services (driven by foreign tourism) and the fall in oil prices.

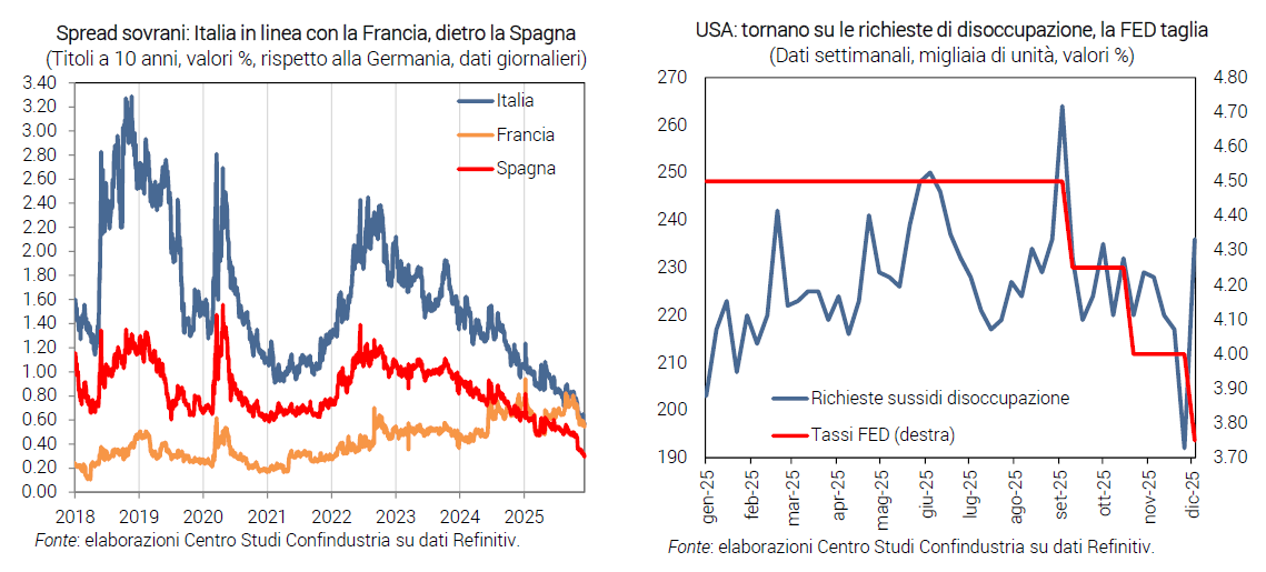

Moderate rates in Italy. In December, BTP yields fell below those of French bonds for a few days, but on average for the month they were in line: 3.49% in Italy (+0.57 spread over Germany) and 3.48% in France (+0.56). Spanish yields are lower: 3.23%, +0.30 spread. With ECB rates unchanged (2.00%), the cost of credit for Italian businesses is no longer falling (3.52% in October, almost the same as in July).

FED cuts, weak dollar. The US Central Bank cut official rates for the third consecutive meeting (3.75% in December), concerned about the slowdown in employment, announcing further cuts without a defined timing. This contributed to a weaker dollar against the euro: 1.17 in December, close to its peak.

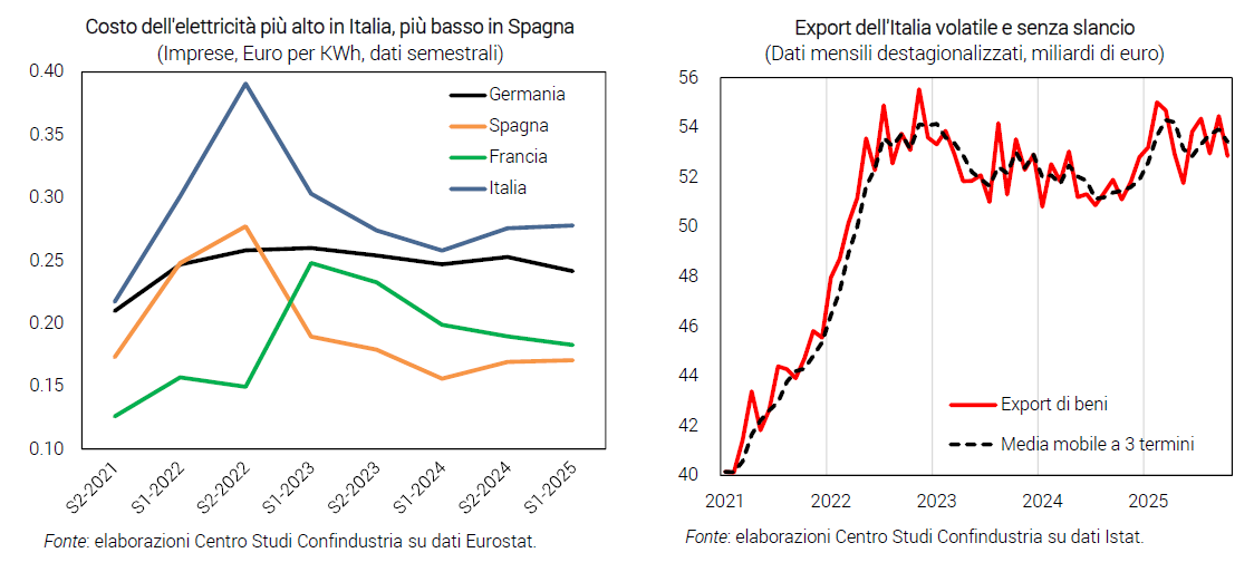

Electricity still expensive. The slow decline in oil prices continues (63 dollars per barrel in December), slightly below the 2019 average; gas prices are also falling (27 euros/MWh), but are still double the pre-2022 values. As a result, consumer inflation in Italy is moderate (+1.11% in November), but the cost of electricity for businesses remains high: €0.28/KWh, compared to €0.18 in France and €0.17 in Spain.

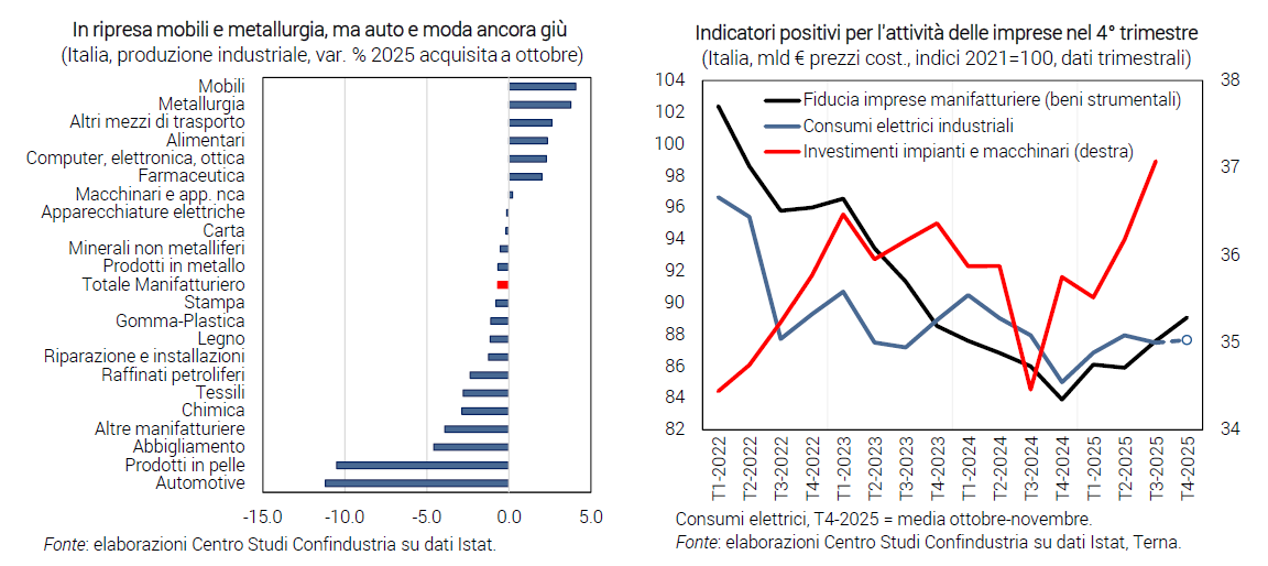

Investments: still positive signs. Following the positive performance in the third quarter, indicators for investment in plant and machinery remain favourable at the end of 2025: electricity consumption rose in November, and in the fourth quarter, confidence among capital goods companies (especially production expectations) remained high on average, as did confidence among construction companies, despite a slight recent decline.

Consumption: low confidence. In October, retail sales grew (+0.5%, but no change for the fourth quarter) and in November car sales increased moderately. Furthermore, after declining in July-August, the number of people in employment returned to growth in September-October. However, household confidence fell sharply in November, recovering only partially in December.

Services in acceleration. RTT (CSC-TeamSystem) reports that services continued to expand in October, following a full recovery in September. In November, the HCOB-PMI (55.0 from 54.0) suggested a healthy pace of growth in the fourth quarter, confirmed by a jump in business confidence in the sector in December.

Industry still weak. Industrial production fell again in October (-1.0%), as anticipated by RTT, bringing the change in the fourth quarter to -0.1%. In the first ten months, there was a clear recovery in metallurgy and furniture, but difficulties remained in fashion and automotive. In November, however, the PMI returned to expansionary territory (50.6) and business confidence remained on a positive trend in December.

Falling exports. Italian trade in goods was weak in October: imports were almost flat (+0.3% at current prices), while exports fell (-3.0%, after +2.9% in September), due to the collapse in capital goods (-8.5%; -1.1% net of ships). Sales, on the other hand, are growing in a few sectors (especially pharmaceuticals) and in a few destinations (Switzerland, OPEC, France, Spain, but also the US itself). The outlook for exports remains negative, with a further decline in foreign manufacturing orders in December.

Eurozone: services outperform industry. In October, industrial production grew in the main countries: most significantly in Germany and Spain (+1.1% and +1.0%), and less so in France (+0.4%). In November, however, the manufacturing PMI fell in the three countries, remaining expansive only in Spain. In services, on the other hand, the PMI rose back into positive territory in France as well, slowing slightly in the other two countries. Furthermore, confidence and employment expectations improved slightly for the Eurozone as a whole.

USA: the economy slows down. The composite PMI remained expansive in November, but fell (54.2 points) due to declines in services (54.1) and manufacturing (52.2). The latter, in particular, presents a weak overall picture: ISM and Chicago PMI remain at recessionary levels, as do various regional indicators from the Fed. The US labour market deteriorated in mid-December, as indicated by a rapid increase in unemployment benefit claims.

China: exports pick up again. The Chinese industry is slowing down, with November production at +4.81% year-on-year (down from +4.91%), in line with the PMI (49.9 from 50.6). Exports bucked the trend, returning to growth in November (+5.91%, up from -1.11%): although sales in the US fell (-28.61% year-on-year), they grew in other markets (Southeast Asia +8.41% year-on-year, Africa +28.01% year-on-year, EU +14.81% year-on-year). Domestic demand, however, recorded its lowest growth since the “zero-Covid” policies (2022), with retail sales at +1.3% (from +2.9%).

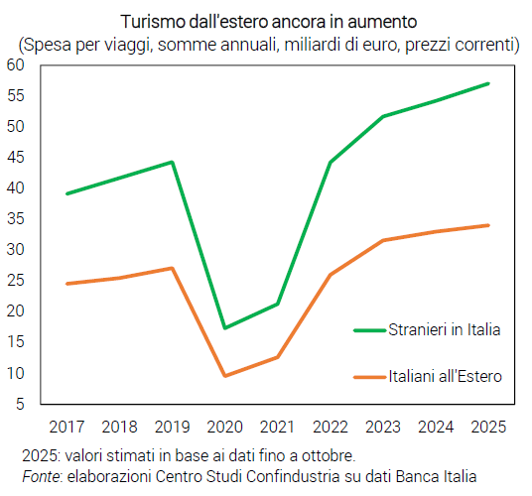

Tourism continues to grow thanks to foreign visitors

Spending by foreign tourists on the rise. Foreign tourism accelerated its expansion in October (+7.41% annualised expenditure), when evaluated at current prices. Foreign expenditure in Italy is estimated to close the year at around 57 billion, up +5.21% on 2024. Outbound tourism, i.e. Italians travelling abroad, is growing at a slower pace (+3.11% in 2025) and remains lower. Italy's tourism balance is therefore largely in surplus and has been growing in recent years (+23 billion estimated in 2025, up from +21 in 2024), making an important contribution to the solidity of our foreign accounts.

Arrivals down slightly, overnight stays at an all-time high. Tourist arrivals in Italy peaked at 140 million in 2024 (+4.51% compared to 2023). In 2025, however, a slight decline is estimated, to 138 million (-1.4%), based on data available up to September. Foreign tourist arrivals in Italy (75 million in 2025, up from 65 million in 2019), although slowing down, continue to grow weakly (+0.9%), while Italian tourist arrivals are declining (63 million, now equal to 46% of the total, -3.9% in 2025), after the recovery recorded until 2023, thus returning well below the 2019 level (66 million). However, overnight stays are on the rise: +10 million, reaching an all-time high (476 million nights) thanks to the increase in the average length of stay.

Prices for tourist services are rising. The expansion of tourist spending at current prices, while arrivals stagnate, is explained to a significant extent by the increase in price lists. Tourism prices are, in fact, those that are growing the most in Italy: for the prices of “accommodation and catering services”, the change acquired for 2025 with data up to November is +3.4%, more than double the total consumer price trend (+1.5%). In addition to these, other prices also count, such as those for “museums and parks”, which are also rising sharply (+2.9% in 2025).

Attendance concentrated in the centre-north. According to the latest ISTAT data, which allows for a territorial breakdown, tourists in Italy in 2024 were mainly distributed in the North-East (38.8%), the Centre (24.7%) and the North-West (17.0%). Lower numbers were recorded in the South (12.3%) and the Islands (7.1%). The Northern and Central regions mainly host foreign tourists (57-58%), while the Southern regions mainly host Italian tourists (64%) and the Islands record almost equal numbers (51% of foreigners).

Tourism linked to large urban centres. Large cities accounted for 22% of tourist arrivals in Italy, followed by coastal towns (19%), which are, however, subject to greater seasonality. The provinces of Rome and Venice alone recorded 47 and 38 million overnight stays by tourists respectively, or 10% and 8% of total tourist arrivals in 2024.

Tourism brands account for almost a third of visitors. In 2024, 133 million nights were spent in regional tourist “brands”, i.e. geographical areas or specific areas with a strong identity and a well-defined image at international level (29%). Tourists concentrated mainly on Lake Garda and the Romagna Riviera, which each account for about one-fifth of the total number of visitors to these brands, with a clear prevalence of foreigners in the former (22 million compared to 4 million) and Italians in the latter (20 million compared to 6 million).

Small international destinations experiencing strong growth. According to the latest data available from the World Tourism Organisation, the international destinations with the highest growth in terms of foreign tourist arrivals are Qatar (+1,30% in 2024 compared to 2019, reaching +1,38% in the first nine months of 2025), Bhutan (+1,27% and +2,03%), Albania (+85% and +83%), and the Seychelles (+83% and +106%). Italy, while not recording such high growth rates, remains among the top destinations for tourist arrivals: it ranks third among European destinations, behind Spain (first in the world), which recently surpassed France. However, if these growth rates for new international destinations continue in the medium term, there could be increasing pressure on domestic destinations.

Tourism crucial for GDP. Statistical analyses show that the tourism sector in Italy accounts for a significant share of GDP and employment. In recent years, its growth has underpinned the otherwise sluggish Italian economy: it is crucial to boost tourist arrivals in order to continue to rely on this driving force.