News

Share on

Le Italian bills remain among the most expensive in Europe. This is what emerges from the elaborations of Confindustria on data Eurostat e GME for 2025which confirm a competitive and structural gap compared to the main EU countries in all consumer segments.

The differences result from higher raw material prices, higher grid and dispatching costs and lower compensation for indirect ETS costs.

Energy prices: Italy +30% above European average

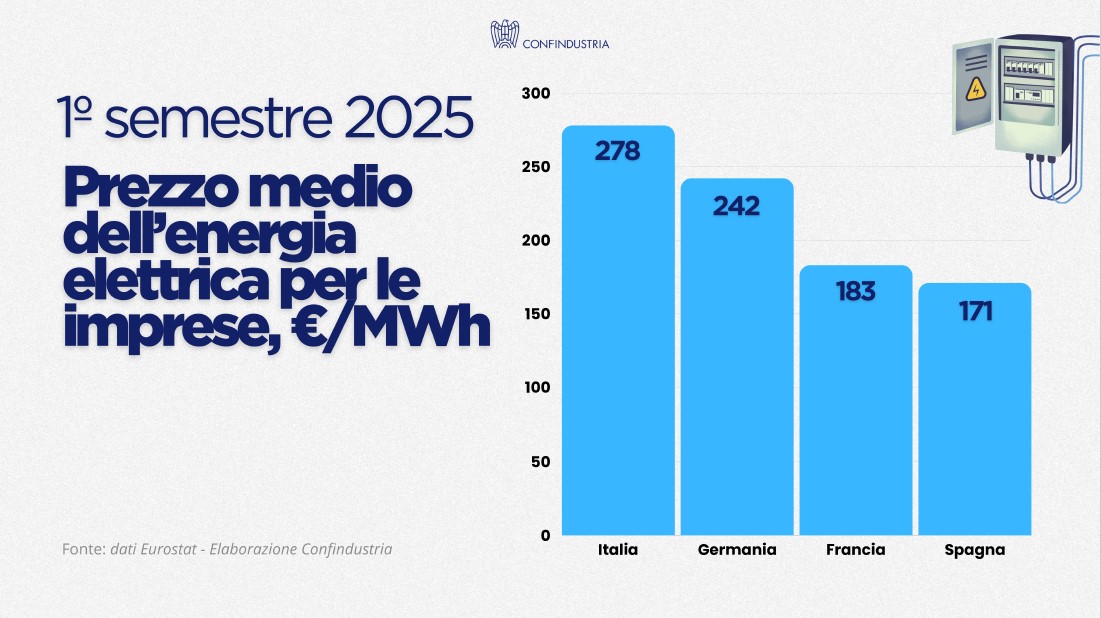

In the first half of 2025, Italian companies paid an average of 278 €/MWhcompared to 242 in Germany, 183 in France, 171 in Spain and 216 in the European average.

The Italian price is therefore almost 30% more than the EU averagewith a burden that affects SMEs and large consumers across the board.

Wholesale prices: structural differential with main European competitors

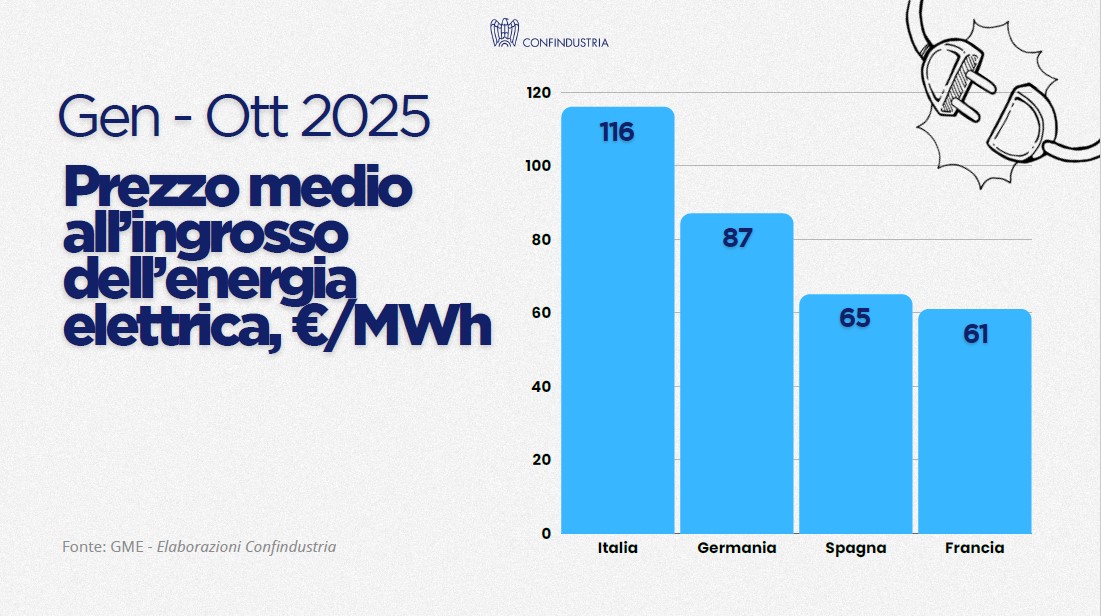

According to GME data (January-October 2025), the average wholesale electricity price in Italy was 116 €/MWh87 in Germany, 65 in Spain and 61 in France.

A gap that reflects the different composition of the energy mix:

- in Italy, natural gas covers 70% of production hours;

- nuclear power dominates in France;

- coal and wind power prevail in Germany;

- in Spain, the mix is more balanced between gas, nuclear and renewables.

The wholesale price of electricity is defined, every hour, by the most expensive plant still needed to meet demand: this is known as 'marginal technology'. In Italy, for most hours, this role is played by thermoelectric power plants fuelled by natural gas, which emit CO₂. In countries like France and Spain, on the other hand, the mix includes a significant share of nuclear power, which does not emit CO₂ during generation and often determines the price.

In addition, the price of natural gas in Italy is higher than in Germany (PSV-TTF spread) and this is reflected in the electricity price with negative impacts for all consumers amounting to about 1 billion€ per year, about 5/6 €/MWh.

Network costs: a double burden for Italian companies

Also network and dispatching costs remain significantly higher. A company with average consumption (3.7 GWh) incurs a cost of about 133,000 euros in Italy, compared to 78,000 in France (+70%).

For a small company (755 MWh), the Italian expenditure is 25,000 euros, more than double the less than 10,000 euros in Spain.

ETS offsets: Italy at the tail end

On the compensation for indirect ETS coststhe distance is even more marked: Germany EUR 2.4 billion, Italy just EUR 150 million (rising to 600 million from 2025).

A difference that further penalises the competitiveness of energy-intensive Italian companies.

Priorities according to Confindustria

To bridge the gap, Confindustria indicates some strategic lines of action:

- decoupling the price of renewable electricity from the price of gas, including through long-term contracts;

- fully implement the energy release;

- strengthen ETS compensation;

- reduce general system charges and network costs;

- favouring a more competitive energy mix based on renewables and nuclear power;

- eliminate the PSV-TTF gas spread and promote long-term contracts for biomethane.

Summing up, the objective is to bring Italian energy costs in line with the European average and to return businesses to competitive conditions and sustainable growth.