December 2025

November 2025

October 2025

April 2025

February 2025

December 2024

Stunted restart. At the beginning of 2025, support for the economy comes from continued rate cuts even though inflation is rising fuelled by rising gas and electricity prices. Industry is in crisis and services drive little. Italy's GDP, at a standstill in Q3 and Q4 2024, is expected to grow slightly. The outlook is weighed down by uncertainty over possible US duties, which risks holding back trade and investment.

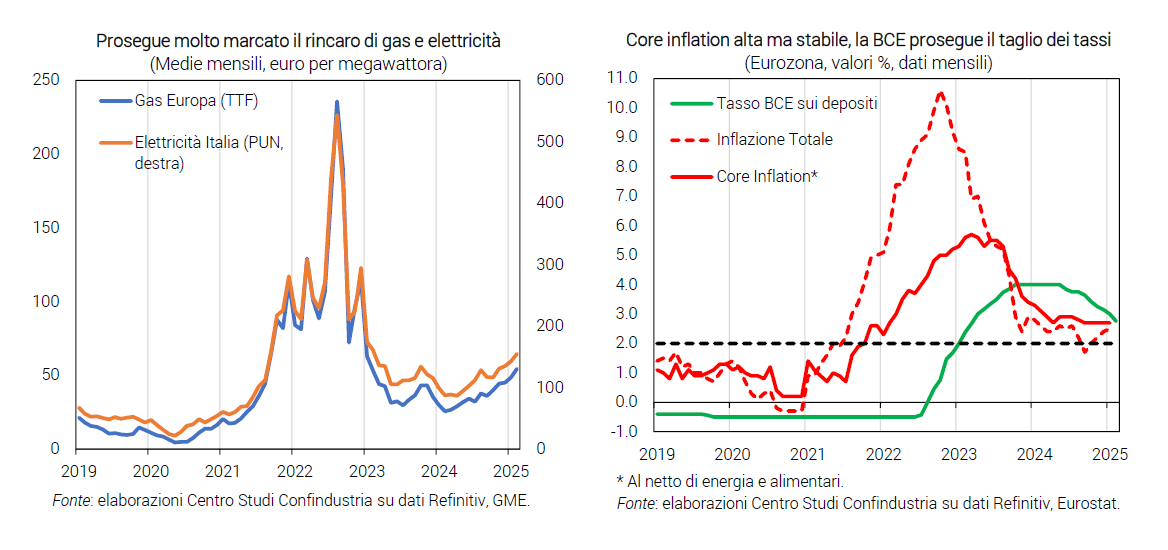

Gas prices more than doubled. The increase in gas prices in Europe continues unabated: 53 €/mwh in February, up from 49 in January (26 a year ago). Businesses and households will also pay more for electricity, as the price in Italy remains closely linked to gas: PUN at 155 €/mwh in February, up from 143 (88 a year ago). Oil prices, on the other hand, are falling (76 $/barrel, from 79).

Inflation rises. In the Eurozone, consumer energy prices are now rising (+1.8% p.a. in January) and the core is high and stable (+2.7%): inflation is therefore rising (+2.5%). In Italy, energy prices have risen almost to zero (-0.7% p.a.) and the core is stuck at lower values (+1.6%): inflation is slowly rising to +1.5% at the beginning of 2025, from a low of +0.7% during 2024.

Rates: the cut continues. At the end of January, the ECB cut rates by another quarter of a point (2.75%, from the initial 4.00%), as it looks to inflation over the medium term, which is expected to moderate; according to the markets, there will be two more cuts in 2025. In Italy, the corporate rate has fallen by more than a point so far (4.40% in December, from a peak of 5.59%), but credit remains on the decline (-2.3% annually).

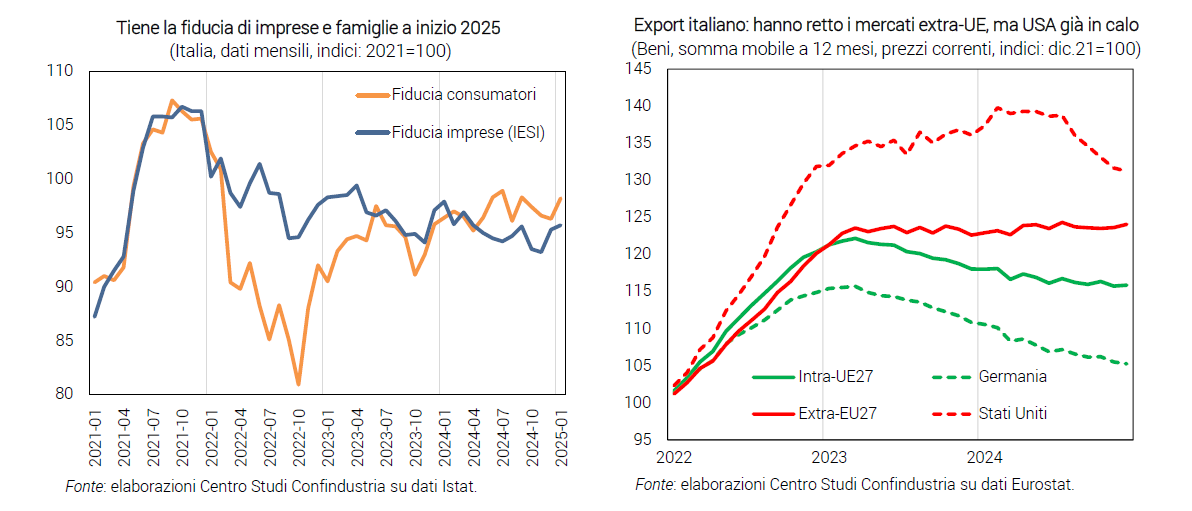

Investments are struggling to restart. Business confidence in January rose only slightly (95.7 from 95.3), to values close to the 2024 average, and uncertainty barely reduced. On the demand side, at the beginning of 2025, judgements on orders recovered a little in manufacturing, a little more in services. Overall, business investment still does not seem to benefit from the less restrictive monetary policy.

Consumption: uncertain growth. In December, there was a recovery in retail sales (+0.8%), which limited the decline in Q4 to -0.2%. In January, consumer confidence recovered, albeit at a low level (98.2, from 96.3). Further monetary policy easing stimulated the credit channel and total income rose in 2024. In contrast, the CCI indicator suggests a slowdown at the beginning of 2025.

Services: modest growth. Foreign tourist spending settled into a moderate expansion (+1.3% per year in December). In January, the RTT index (CSC-TeamSystem) reported a decline in turnover in services; the PMI fell and remained barely in the expansionary zone (50.4 from 50.7), indicating a lacklustre growth; business confidence in the sector also fell at the start of the year (99.0 from 99.6).

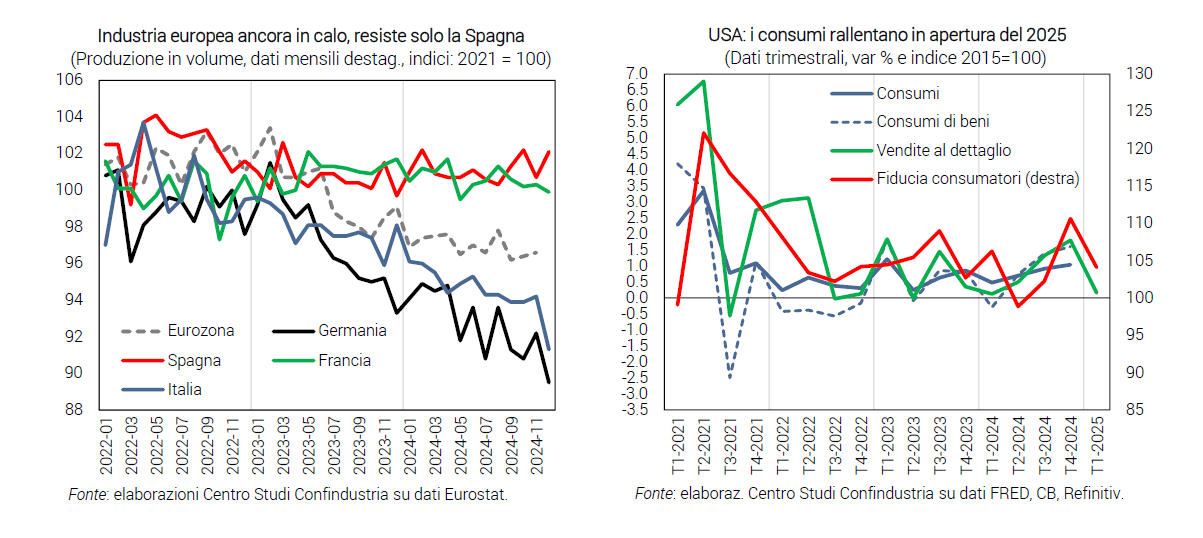

Industry in the doldrums. Production fell in December (-3.1%) after a marginal recovery in November: -1.1% in Q4, the 7th consecutive downturn: automotive marks a -36.6% on December 2023. In January, the HCOB PMI remained recessionary (46.3 from 46.2) and the industry RTT indicates declining turnover; confidence remains low, production expectations improve but remain modest.

Weak exports. Italian goods exports showed a moderate upturn in December (+1.9%), but overall in 2024 they remained slightly negative (-0.4% at current prices), due to the drop in intra-EU sales (-1.9%), only partly offset by an increase outside the EU (+1.2%). Among sectors, pharmaceuticals and food were positive, and automotive and leather goods negative. Among countries, decline in the first markets (Germany, USA, France), growth in other important destinations (Spain, UK, Turkey).

Eurozone: industry does not restart. According to the manufacturing PMI, the main Eurozone economies were below the expansion threshold in January, excluding only Spain. Thus, the picture offered by the industrial production data for December did not change: Spain up (+1.4%), Germany down sharply (-2.9%) and France down slightly (-0.4%); Q4 2024 also closed well only in Spain (+0.9%) while it was negative for Germany and France (-1.2% and -0.7%).

US: sluggish domestic demand. Industry in January rose above expectations (+0.5% output), outlining a positive Q1 2025 (+1.1% gained, after -0.3% in Q4 2024). Retail sales, on the other hand, fell sharply (-0.9%) for the first time since August, but the Q1 acquisition remains positive (+0.2%). The dynamics of employment also slowed down (+143,000).

China: slowdown in consumption. Industrial production accelerated a little in November (+5.4% p.a., from +5.3%), driven by high-tech (+8.7%) and industrial equipment (+7.8%); PMI indicators suggest that manufacturing slowed in January, although remaining in expansionary territory. Meanwhile, consumption growth slowed down (+3.0% p.a. in November, from +4.8%) and price dynamics remained low: consumer prices were at +0.5% p.a. in January (from +0.1%), manufacturing was at -2.3% for the second consecutive month.

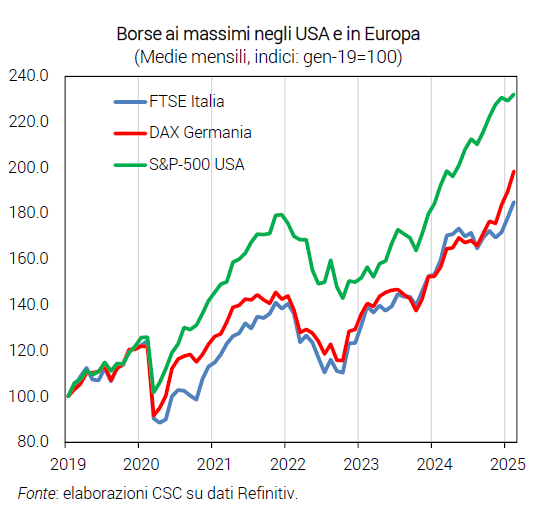

Stock market prices at highs. In the US, the S&P-500 index in February 2025 is +132% higher than its levels at the beginning of 2019, mainly due to the strong increase during 2024 (presidential election campaign, news about the Russia-Ukraine war); the Nasdaq 'technology' index shows an even larger increase (+228%). In Europe, the stock exchanges are rising rapidly: in the German DAX +8.0% in February over the end of 2024, in the Italian FTSE +7.7%; with this further leap, the quotations are at +98% in Germany and +85% in Italy from early 2019 levels.

Bank shares fly. Particularly positive is the trend in the banking sector. In Italy +199% in 2025 over 2019, in Germany +170%. In the US, the increase for the sector is also marked. This is due to the high interest rate environment in both areas, at highs until mid-2024 and still high today, which together with other monetary policy measures (securities purchases, loans to banks) has supported the profitability of institutions in the Eurozone and the US.

Stock exchange and real economy. There has historically been a significant link between financial markets and the real economy in the medium to long term, although short-term dynamics may diverge markedly in some cases. The correlation between the dynamics of stock market prices and that of GDP (calculated on quarterly, raw, current-price data), in Italy was 78% in the period 2019-2024, a very high value, despite the fact that the stock market in Italy counts for less than in other economies such as the US and the UK.

Interaction channels. The channels through which the stock market has an impact on the real economy are multiple. Higher stock prices, by increasing the financial wealth of households, can have a positive effect on consumer spending, especially on durable goods. Similarly, higher stock prices can make it easier for companies to raise medium- to long-term resources on the markets, to finance new investments and also to support an increase in current production activity.

Company choice and the stock exchange. It turns out, in fact, that the dynamics of industrial production, business investment and the stock market in Italy, in some periods, have a similar profile, for example in 2019-2020; production in 2021 took a divergent path, only to realign with the stock market in 2022; in 2023-2024, on the other hand, the run-up of Piazza Affari does not seem to be reflected in the macro data, at least so far. Overall, in the 2019-2024 period, the correlation in Italy between the dynamics of the FTSE index and that of industrial production was 68%, that with investments 47%, both very significant values.

Markets and trust. Stock market prices tend to rise when confidence spreads among financial players about the trends of individual companies and the economy. Stock market trends are therefore also often interpreted as an indicator of 'confidence', albeit only of a part of the operators. There also tends to be a correlation between stock exchanges and indices of confidence: in Italy, business confidence rose in December and January, along with share prices. And greater confidence certainly stimulates investment and consumption, hence GDP.

Good indicator for GDP. Therefore, the stock market price run of 2024 and early 2025 may be a positive indicator: it suggests, in the medium term, a resumption of GDP growth in Italy (and Germany), reconciling the trajectories of the financial market and the real economy. Unless time proves that it was the current stock market rises that were excessive, unrelated to the difficult underlying dynamics.

But high uncertainty. One caveat is that the rise of stock markets is never linear: it proceeds with short-term swings, even large ones: the VIX index, which measures precisely such stock market volatility, is high today (15.2, up from 13.8 at the end of 2019). And such market volatility is often associated with high uncertainty, as was recently the case in the wake of the US tariff announcements: the global EPU index jumped to 375 at the end of 2024, a value second only to the peak during the pandemic. And uncertainty is the enemy of investment (companies) and consumption (households) choices. Therefore, a positive but volatile stock market trend does not always translate into simultaneous GDP acceleration.