Ciro Rapacciuolo

Share on

Economy almost at a standstill. The price of oil is no longer falling, the weak dollar is jeopardising exports, the cases of Venezuela and Greenland are fuelling the uncertainty that in Italy is pushing families to save, curbing consumption. On the positive side, the latest acceleration on the PNRR, the reduction in sovereign rates, the rise in credit. Industry remains volatile, investments are the only boost to GDP.

Oil and gas prices are rising. The downward trend in the price of oil is reversed at the beginning of 2026: 65 dollars per barrel on average in January (peak at 69), down from 63 in December. The reason is the US attack in Venezuela, a marginal producer (less than 1% of world crude) but with the largest reserves in the world. The price of gas is also no longer falling (EUR 33/MWh, from 28), at more than double the level of 2019.

Lower rates, tighter spreads. In January, the yield on BTPs fell only slightly and ended up below that of French bonds: 3.45% on average in Italy (from 3.50%), 3.47% in France (from 3.49%); although still above Spanish bonds (3.21%). The Bund yield in Germany continued to rise slowly, (2.97%, from 2.95%) and so spreads narrowed: Spain +24 basis points, Italy +48, France +50.

ECB and FED on pause. Inflation is moderate (+1.9% in December in the Eurozone, +1.2% in Italy) and ECB rates are expected to be firm (2.00%). The markets, for the end-January session, expect a pause by the FED, after three US rate cuts (3.75% in December): two more cuts are expected between June and December 2026. The dollar remains heavily devalued against the euro: 1.17 in January (+13% in a year).

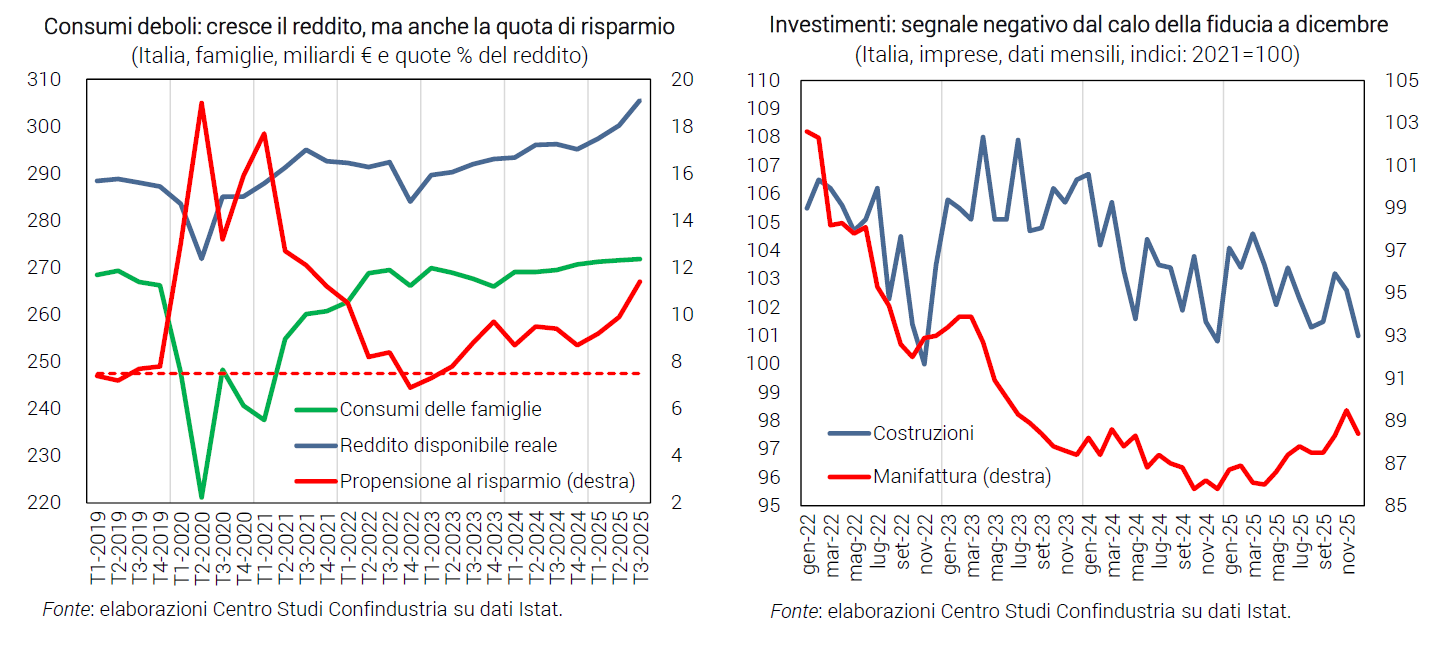

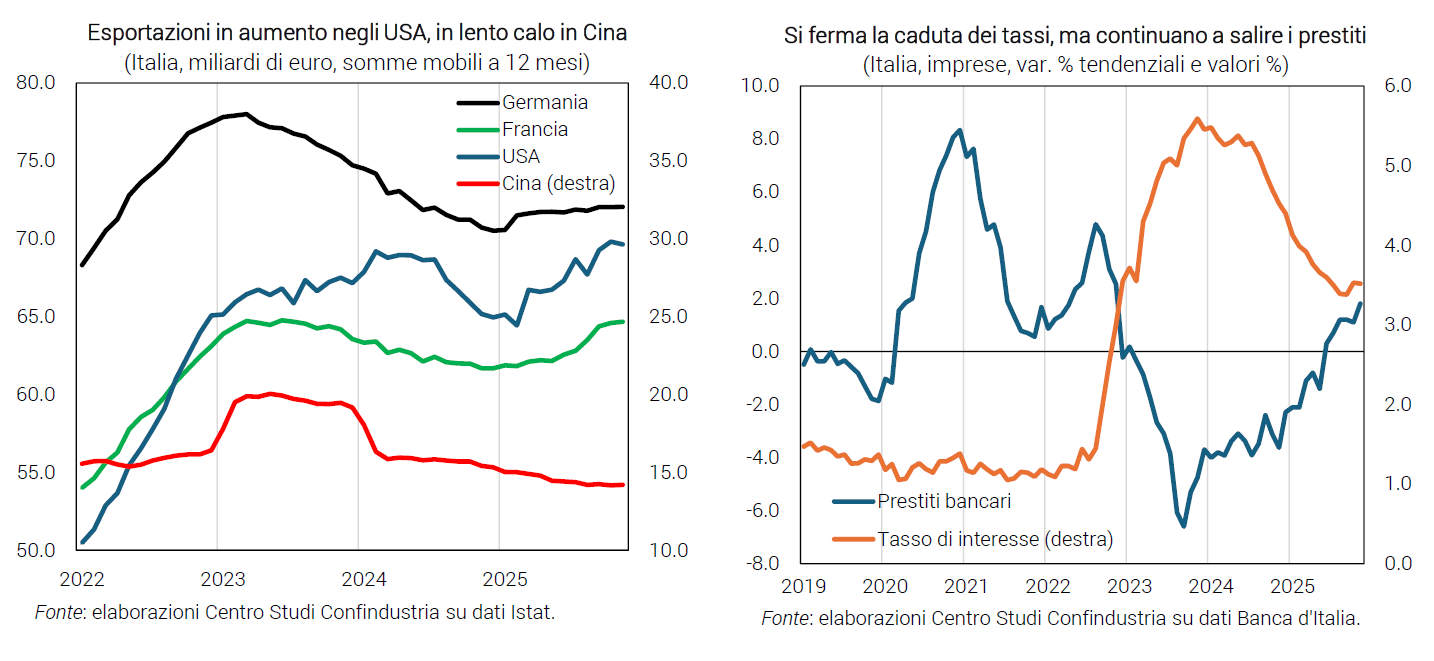

Expanding investments. A number of indicators confirm the positive phase of investments in plant-machinery and construction in Q4: the value of leasing contracts (source: Assilea) increased by 15.2% per year for the purchase of capital goods, by 15.7% for construction. Bank credit is also growing, although the cost for Italian companies is no longer falling (3.52% in November, at July levels). In December, however, the confidence of capital goods and construction companies declined.

Consumption curbed by precautionary saving. The Q3 data on total household income are encouraging (+1.8%). However, the propensity to save, due to uncertainty, took a record leap (11.4% from 9.9%), holding back consumption, which grew by only +0.1%. Retail sales increased in November (+0.6% in volume) and car purchases also rose in December. The number of employed persons, despite a slight decrease in the last month, remains on an expanding trend.

Services: growth slowed down. In December, the HCOB-PMI (51.5 from 55.0), while remaining in the expansionary zone, indicated a weakening of the pace of expansion at the end of Q4. On the other hand, business confidence in the sector increased at the end of the year and spending by foreign tourists increased (+7.31QT trend in November).

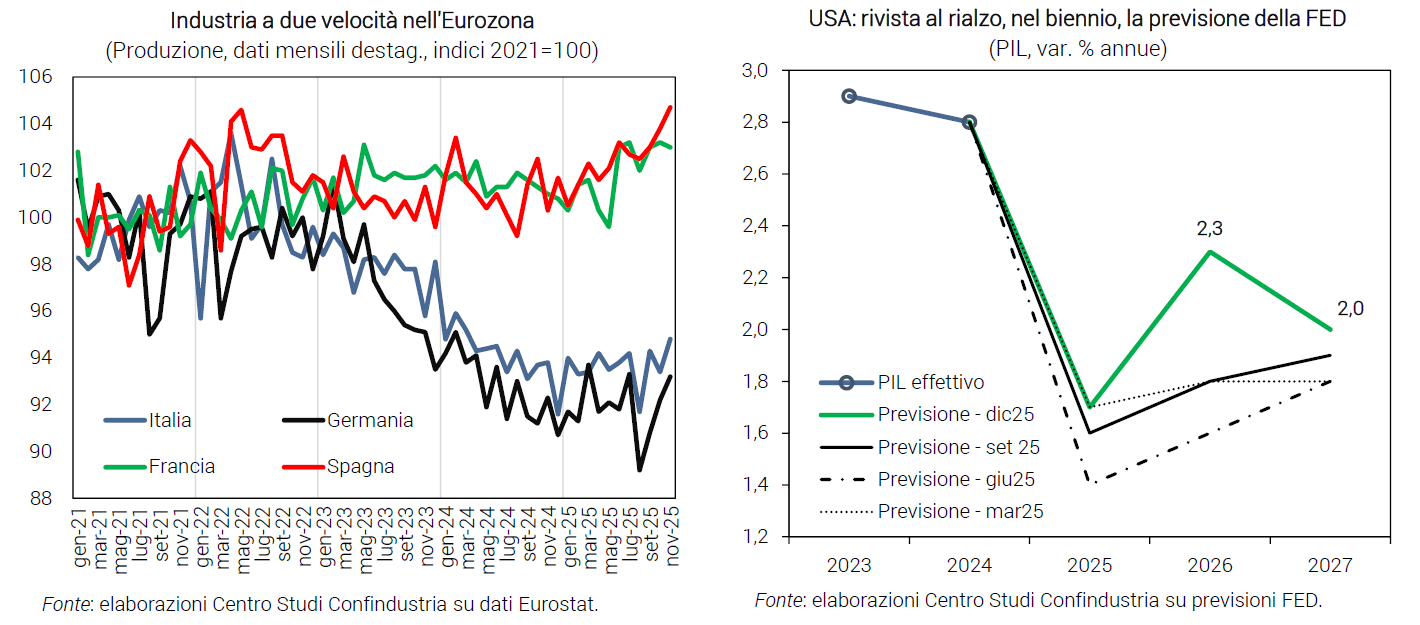

Volatile industry even at the end of 2025. In November, industrial production recovered after October's decline (+1.5% from -1.0%), leading to an acquired change in Q4 of +1.0%. In December, however, the PMI returned to the recessionary area, after the good figure of the previous month (47.9 from 50.6), and industrial business confidence in the final months of 2025 also followed a similar up-and-down profile.

Exports remain weak. Italian goods exports recorded marginal growth in November (+0.2% at constant prices), after the slump in October (-3.1%). Among the destinations: Germany remained weak, France slowed down, the UK and Turkey fell, and the US also turned negative; some EU markets (Spain, Belgium, Austria) and Asian markets (India, Japan), on the other hand, turned positive. The outlook for the end of the year is negative, according to foreign manufacturing orders, due to tensions and uncertainty that are holding back international supply chains.

Eurozone: weak growth. In November, industrial production rose in Germany, rose in Spain (+0.9%), contracted in France (-0.2%); in December, however, the PMI fell in all three countries, remaining expansive only in France (50.7). In services, the PMI was expansive for all, falling slightly in Germany and France, rising in Spain. In the area, confidence and employment expectations fell only slightly in December.

USA: GDP better than expected. The Fed in December revised its forecast for US growth upwards: +2.3% in 2026 (from +1.8%), +2.0% in 2027 (from +1.9%). GDP in Q3 2025 grew more than expected (+1.1%), due to the contribution of consumption (+0.6%), net exports (+0.4%) and, to a lesser extent, government spending (+0.1%). Industrial production did well in December (+0.4%), but manufacturing PMI and consumer confidence signal a possible (temporary) slowdown in Q4.

China: growth target met. GDP is on course for +5.0% in 2025, although slowdown factors remain. Growth is mainly supported by exports, which still accelerated in December (+6.6% annually, from +5.9% in November). Timid signs of recovery from industry (+5.2% from +4.8%), which were confirmed by the PMI (50.1 from 49.9). The brake remains the weakness of domestic demand (retail sales at +0.9%, the worst figure since 2022), which is also disadvantaged by the population that has been shrinking for 4 years.

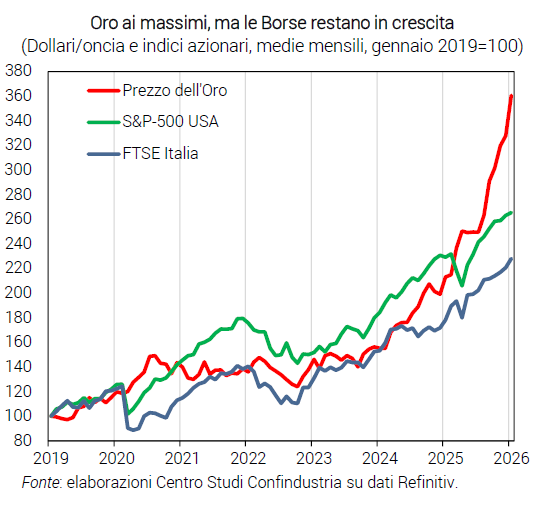

Tensions inflate gold, don't stop the stock market

At highs the price of gold. Gold typically registers marked rises at times of economic crisis, representing the safe haven asset par excellence because it is considered a risk-free asset. Until April 2025 in the wake of the tariff announcements, and then from August onwards as international tensions escalated, the price rose rapidly, exceeding USD 4,000 an ounce in the final months and peaking at USD 4,700 in January 2026. The same has already happened at the turn of recent shocks, albeit on lower values: during the pandemic in 2020 gold touched the $2,000 mark; in 2022-2023, with the war in Ukraine, prices rose just above those levels.

Blame high volatility or uncertainty? The VIX index, a measure of economic uncertainty, peaked at 24.7 in April 2025, still lower than the values reached in 2020 and 2022. In late 2025 and early 2026, however, it shows no new peaks. The VIX measures the implied volatility of the US stock market, i.e. how uncertain prices are. This index has shown in recent shocks a high correlation with the price of gold, linked to the risk perceived by investors: in periods of high instability, the VIX peaks, indicating an uncertain environment among market participants; precisely in these phases, investors' propensity to seek safety in gold increases. Today, however, gold is at its peak, the VIX is not (but other indices of uncertainty are). Some other factor is therefore at play.

Distrust in the USA. The recent loss of confidence in the US stems from the trade policies adopted, doubts about debt sustainability (rising to 120% of GDP in 2025), geopolitical tensions with other countries, and domestic pressure on the Fed. These factors triggered sales of US government bonds (in dollars), causing Treasuries yields to rise (on 10-year bonds to 4.29% in 2025, from 2.40% on average in 2010-2019). On the currency front, the “flight from the US” weakened the dollar against the euro: in January 2026 the devaluation is 13% on January 2025 ($1.17 per euro already in July, from 1.04).

Stock market prices on a positive trend. Since 2025, there does not seem to be a flight from risky assets such as equities, but rather a penalisation of US prices compared to those of the Old Continent, which is part of the phenomenon of distrust towards American assets. In fact, during 2025, the US stock market rose, but decidedly less than those in Europe: +14.0%, compared to +20.0% in Germany and even +28.4% in Italy, which historically showed weaker performances. In January 2026, these relative dynamics continued: +0.9% monthly on the S&P-500, far less than the +3.3% in Milan and +3.7% in Frankfurt. Recently, as an effect of the Greenland announcements, some moderate declines from the peaks reached in early January (around -2/3% in both the US and Europe) can be seen in the daily data; but it is little to say whether this signifies a reversal of the trend, or instead falls within the typical oscillations around the uptrend.

Far from traditional regularities. Historical correlations in financial markets predicted that as the price of gold as a refuge from risk rose, bond yields fell and share prices fell. The trend in 2025 and early 2026 therefore represents a clear decoupling from these past regularities. Today's spike in gold should be explained above all by distrust of the US: since the last months of 2025, US assets have been sold and gold (in dollars) bought with them, with zero effect on the exchange rate. Contributing factors are the “extraordinary” increases in gold reserves of some central banks (Poland, Brazil, India).

Favourable impact on Italian companies. The factors at play today give European stock markets the opportunity to grow more, which makes equity financing relatively easier for Italian or German companies. The resources that companies can raise on the stock markets are important for financing investments, at a time when self-financing has tapered off due to falling margins and the banking channel has only just woken up. This also concerns small and medium-sized companies, thanks to the reforms implemented in Italy after the 2011-2012 credit crunch, in particular the creation of the dedicated AIM (now EGM) market, with reduced costs, simplified procedures, and tax breaks, which enabled 184 SMEs to be listed.