Ciro Rapacciuolo

Share on

The impact of duties is evident. The recent truce between Israel and Palestine mitigates uncertainty and the return of oil prices lowers costs. In Italy there are some positive signs for investments, but in Q3 industry is still struggling and services continue to grow little. US duties and the devalued dollar continue to erode exports, while precautionary savings dampen consumption.

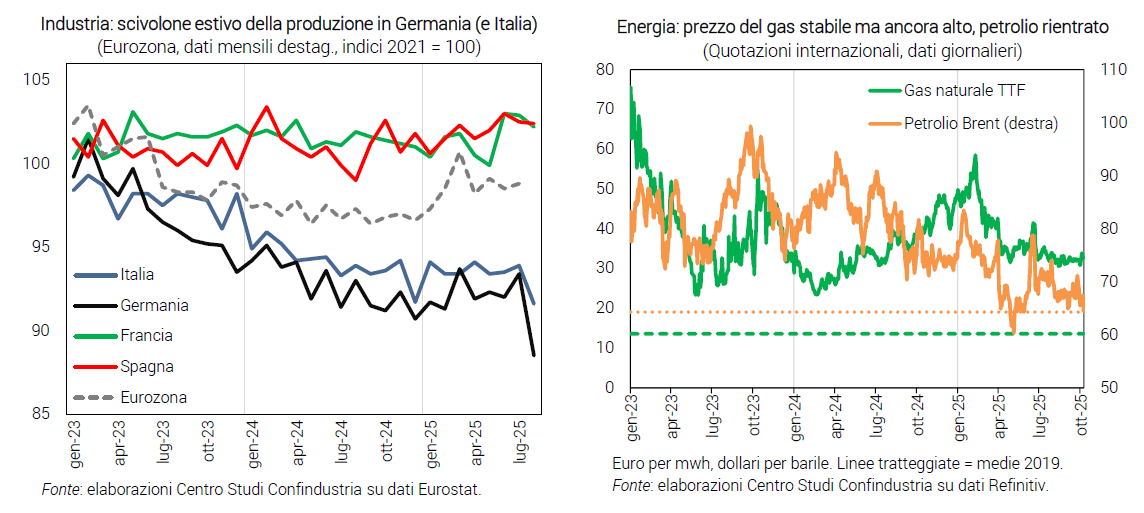

Energy: falling oil prices. The price of gas in Europe has been stable for three months (EUR 32/MWh in October), but is still more than twice as high as in 2019 (EUR 14). Oil prices, on the other hand, continued to fall in October (USD 66 per barrel) and are now in line with the pre-pandemic level (USD 64).

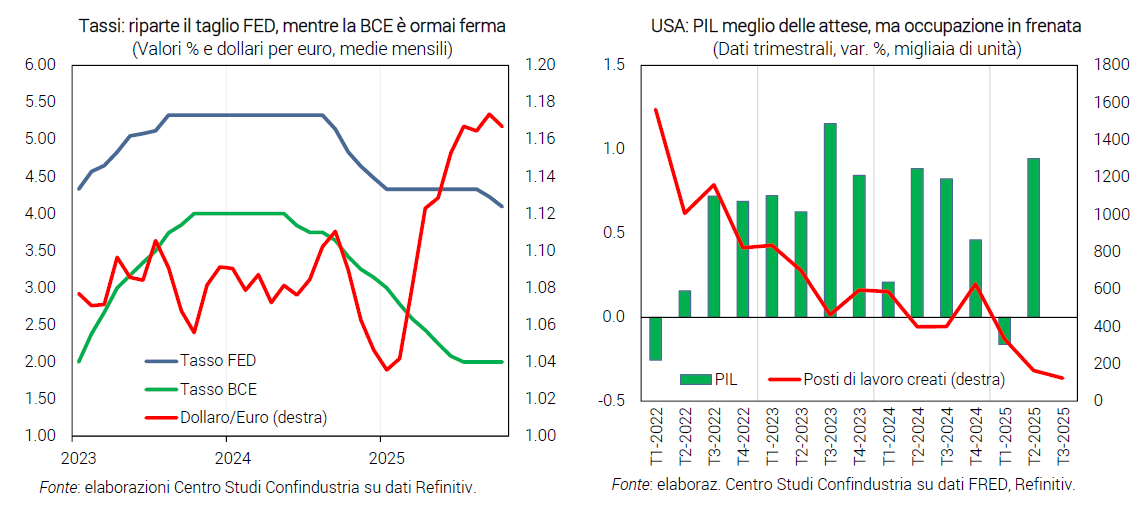

ECB standstill. Inflation remains low in the Eurozone (+2.2% in September), but the ECB seems to have no intention to cut rates further (2.00% since June). The Fed resumed cuts (4.25% in September) and is expected to continue. The dollar remains depreciated against the euro for now: 1.17 on average in October, up from 1.04 in January (+12.7%), reflecting the worsening expectations on the US economy related to tariffs.

The manoeuvre does not raise GDP. The government confirms a falling deficit to 2.8% in 2026 and 2.6% in 2027, thus Italy's exit from the excessive deficit procedure already next year. The manoeuvre for 2026 of about 18 billion will be almost zero balance and, according to the government, will have no impact on GDP. The interventions will focus on: cutting Irpef rates, healthcare, investments, family policies.

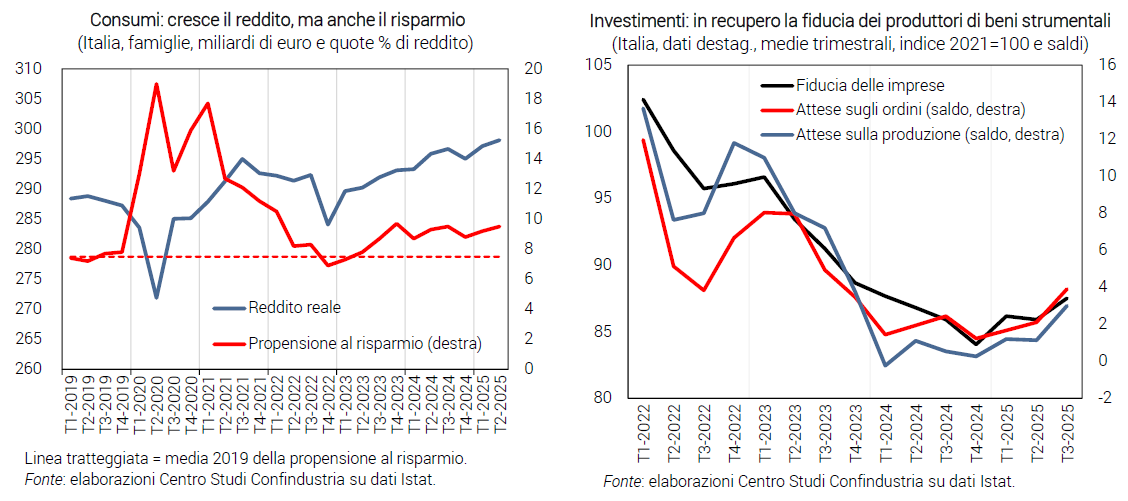

Growing investments. After an excellent 2nd quarter (+1.6%), the indicators confirm the positive phase in the 3rd quarter. In September, the confidence of capital goods manufacturers increased, especially expectations on orders and production. On the other hand, confidence in the construction sector weakened due to negative judgements on orders, although construction plans recovered. The lower cost of credit supported loans (+1.2% per year in August).

Consumption is improving. In Q2 total real household income grew (+0.3%), but an increase in the savings rate (to 9.5%), linked to uncertainty, curbed spending. Q3 looks better: employment paused in August, as did retail sales, but for both the quarterly change in value was positive (+0.1% and +0.3%); in September, household confidence partly recovered (96.8 from 96.2) and motor vehicle sales finally returned to growth in annual terms (+0.4%).

Weak services. For Q3 the indicators on services are mixed. Tourism is growing, albeit slightly (+3.5% per year in July for foreigners). RTT (CSC-TeamSystem) estimates a fall in turnover in August, after an increase in the previous month. In September, HCOB-PMI rises, indicating more expansion (52.5 from 51.5); business confidence recovers from two months, but still at June levels.

Industry: fall and rise? In August, production slipped in Italy (-2.4%), after July's +0.4%, bringing the acquired change for Q3 to -1.4%; data in the first half of the year were positive (+0.3% per quarter). RTT anticipated the July-August upsurge in turnover, and the CSC survey suggests a recovery as early as September. That is endorsed by stabilised industrial business confidence, thanks to less negative orders; less so by the PMI, which is only slightly in the recession area (49.0).

Exports in trouble. The outlook for goods exports remains weak, due to US duties (see Focus). Indications from foreign orders in September uncertain: Istat judgments up, PMI down.

Eurozone: German industry suffers. In August, industrial production shrank throughout the area, especially in Germany (-5.2%); in Q2 in Spain and France it had grown, while in Germany it was already falling. In September, manufacturing PMIs contracted, except in Spain. For services, however, the PMIs were also positive in Germany, not in France. Confidence improved marginally in the Eurozone.

USA: growth slowed down. GDP in Q2 was revised upwards (+0.9% from +0.8% preliminary): consumption (+0.4%), investment (+0.2%) and net exports (+1.2%, thanks to lower imports) contributed positively, partially offset by the contraction of inventories (-0.9%). In September, consumer confidence eased less than expected (55.0 from 55.1) despite the sharp drop in employment in Q3 (+123 thousand, from +249 thousand on average in the first half of the year).

China: exports hold up. Manufacturing conditions in China improved in Q3 (PMI at 51.2 in September from 50.5). Growth is driven by exports (+8.3% year-on-year in September), despite the contraction of sales to the US (-27%). Relations between the two countries plummeted: China imposed tighter constraints on rare earth exports, the US raised tariffs on imports by a further 100%.

Tariffs bring down Italian exports to the US

The EU-US agreement. The new tariff regime between the two sides of the Atlantic has acquired rather definite connotations: zero tariffs on EU purchases of US industrial products; tariffs at 15% on most US imports from the EU (including cars, non-generic drugs, semiconductors); US tariffs at zero or close to zero on other EU products in strategic sectors (aircraft, generic drugs, some natural resources). Unchanged 50% tariffs on steel and aluminium, although the agreement opens up the possibility of expanding the list of preferential products (with tariff reductions within a certain volume).

Uncertainty remains. The agreement includes commitments on the European side of uncertain outcome, because they invest areas that are the responsibility of national authorities and also private companies: purchase of gas and energy from the US ($750 billion by 2028), AI chips ($40 billion) and military equipment; direct investments in strategic US sectors (an additional $600 billion). Finally, President Trump in his statements also included demands on EU trade policies with third countries, such as China and India, which have economic and strategic relations with Russia (e.g. oil and gas purchases). The risk is to open new tariff escalation fronts for European products.

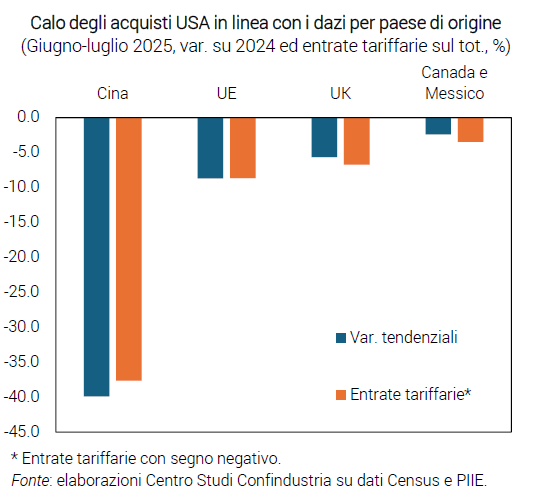

US imports from the EU down. Duties and the strong euro against the dollar (which they have brought about) greatly penalise the price competitiveness of European goods in the US, especially against US domestic production, and also in the rest of the world. US purchases from the EU decreased by 8.7% per year in June-July. This was worse than the flat trend for total US imports, which were still supported by increased purchases from some Asian countries (excluding China), in anticipation of the reciprocal tariff hike in August (frontloading). The drop in US imports from the EU and other major supplier countries was similar in absolute value to the actual level of product duties: purchases from China fell by 39.9% in June-July, with an average applied tariff of 37.7%. Flows from the UK and USMCA countries (Canada and Mexico) fell by less, due to more moderate effective duties, lower than the world average. The decline in US purchases from major suppliers is the result of a contraction in both volumes and average unit values of imported products, signalling a possible partial adjustment of prices by exporters to mitigate tariffs and, in general, a rebalancing of imports in favour of lower unit value products.

The quality of EU products shields duties. High-quality European products, designed to meet customers' needs, are more difficult to replace. This makes some Italian and European exports relatively more resilient to duties in the short term. However, a substitution process will set in over time if duties persist and if US (or USMCA) production capacity becomes adequate to meet demand. In addition, the US economy is expected to slow down due to higher costs and prices resulting from the imposition of tariffs on importers, while the FED rate cut, to support growth, tends to further weaken the dollar, raising imported inflation: this slows down US imports.

Italian exports fell in August. Italian exports of goods to the US plummeted in August (-21.1% over August 2024), after a strong increase in the first part of the year due to the pre-Thanksgiving frontloading. This contributed more than two-thirds to the fall in non-EU exports (-7.0% trend; -1.1% world total).

The effect of duties on exports in the medium to long term. In the medium term, according to CSC estimates, the new duties could reduce Italian sales to the US by about EUR 16.5 billion (compared to a scenario without tariffs), equal to 2.7% of total exports. The impact is greater for core manufacturing sectors: motor vehicles (the most affected in % of sectoral exports), food and beverages, machinery, leather and footwear, and other manufacturing activities. Moreover, the losses are amplified if one considers the indirect effects, along European production chains, of the drop in exports to the US of other EU countries on the demand for Italian inputs. The overall impact is -3.8% of manufacturing exports, -1.8% of production. In the long run, there is a strong incentive to relocate some production to the US market: the risk for European industry is to lose vital parts of the production fabric.