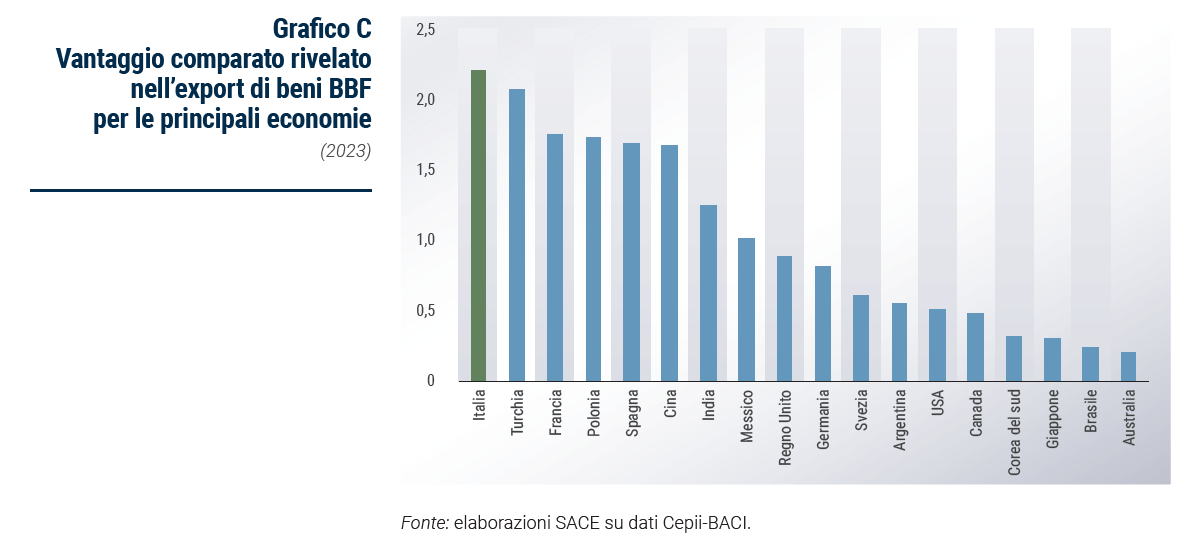

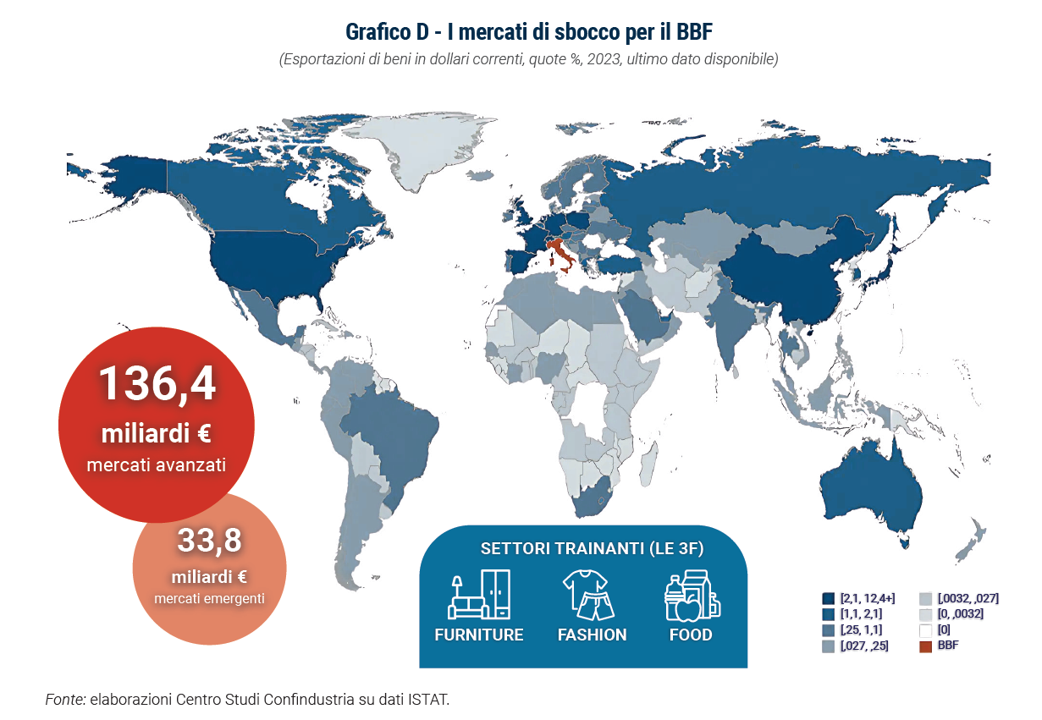

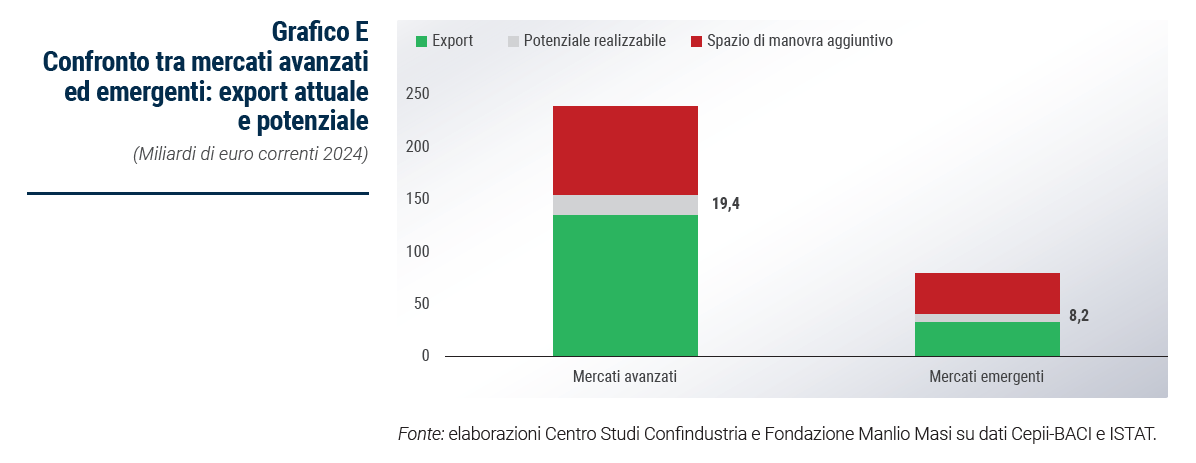

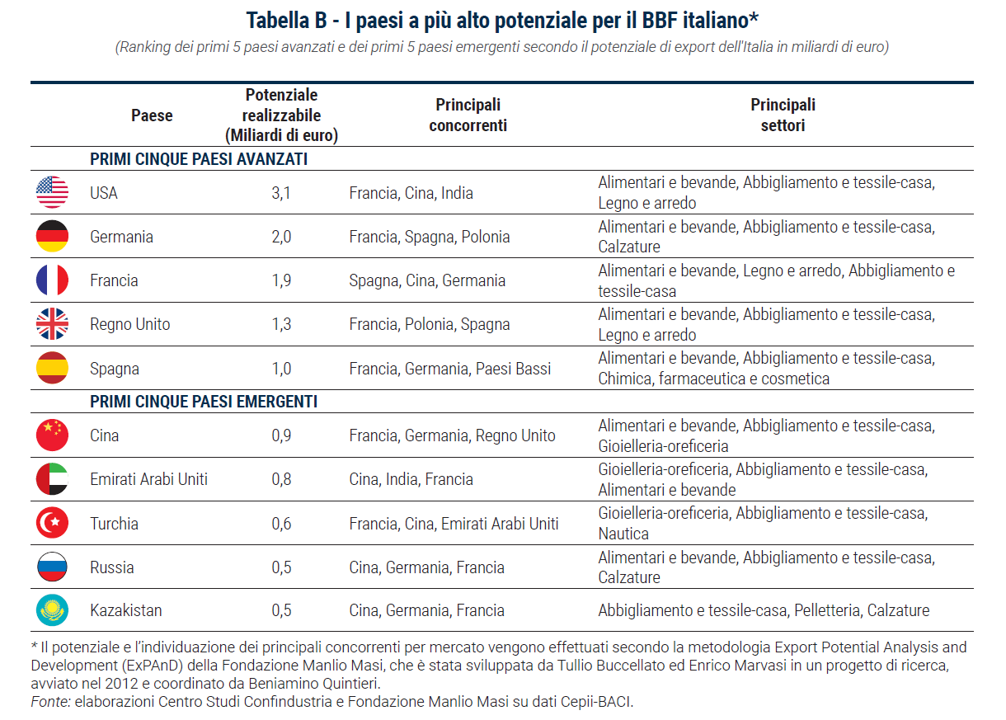

The most important destination for potential extra-EU exports is the United States, with EUR 3.1 billion of additional potential exports compared to the EUR 20.3 billion already realised in 2024. However, realising this will be particularly challenging due to the new tariff barriers imposed by the second Trump presidency. Fundamental remain the main EU partners: Germany (2 billion against 18.3) and France, BBF's first destination country in Europe (1.9 billion potential against 21.7 actual exports). Despite Brexit, the UK remains a key outlet (EUR 1.3 billion against 9.5 realised). The sectors that export the most there are those linked to the '3Fs', while the competitors that use it the most are France, Spain and China.

Among the emerging economies, China is confirmed as the country with the highest potential for BBF (almost EUR 1 billion compared to just over EUR 5 billion realised in 2024). The United Arab Emirates is second (800 million additional potential export compared to 3.9 billion already realised) followed by Turkey (600 million out of more than 7 billion actual exports). Russia is a market that would rank fourth in terms of exploitable potential in the ranking of emerging markets but, following the invasion of Ukraine, it is unrealistic to think of an intensification of trade. The most flourishing sectors in these markets are food and beverages, clothing and jewellery, while the three main competitors of Italian companies are France, Germany and China, with the latter taking a more prominent role.

The Latin America and Caribbean (LAC) region has a considerable openness to foreign imports In international comparison, LAC countries are characterised by high per capita imports (higher than in ASEAN). Made in Italy, in this framework, could therefore considerably increase its market share, as it has always been perceived as a guarantee of quality. It should also be noted how the high incidence of inhabitants of Italian origin makes the population of the area very prone, in terms of tastes and lifestyles, to BBF products.

Italy's presence in the ALC area is already consolidated... The Bel Paese seems to be already well established in the area and seems to be on the right path to further strengthening. The share of total Italian exports held by the LAC area stands at 5.2% with a total value of exported goods of 19.5 billion euro (2024, latest available data). Out of the total exports to the area, Mexico stands out, with a share of 33.5%, and Brazil, which absorbs 28.7%. They are followed, at a considerable distance, by Chile (6.7%) and Argentina (6.0%).

...and the export of BBF goods grew more in LAC than in the rest of the world The dynamics of BBF goods exports to LAC countries have been strongly positive and have been growing since the post-pandemic period. In fact, BBF goods exports to the area recorded an average annual growth rate (CAGR) of +10.0% between 2018 and 2024, compared to an average annual growth rate to the rest of the world of +6.7%. Above all in this area, Italian BBF exports, despite the geopolitical and economic upheavals that have occurred in the post-pandemic era, have nevertheless proved to be dynamic and capable of facing the challenges posed by the world economic chessboard.

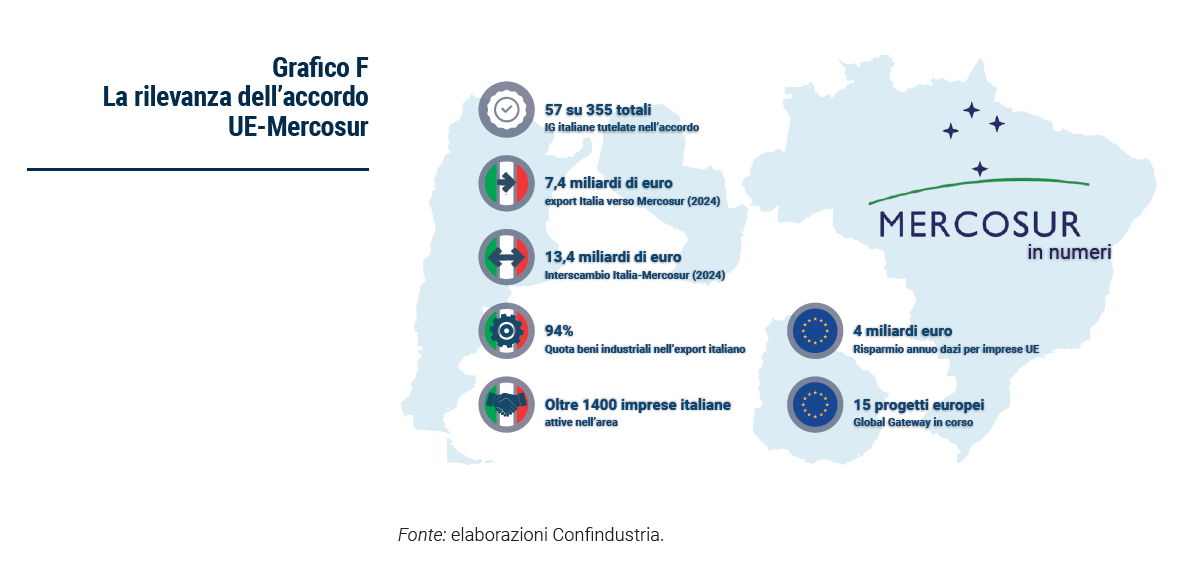

The finalisation of the Mercosur agreement could be a driving force for the BBF As far as the EU is concerned, the importance of signing free trade agreements with LAC countries is crucial in order not to lose ground to the US and China. The successfully concluded negotiations in 2024 and the subsequent approval by the European Commission in September 2025 for trade liberalisation between the EU and the Mercosur bloc is a clear sign of how Europe aims to increase its role as a credible trade partner in Latin American countries. The importance of this agreement lies in its size (Chart F): four countries with around 300 million consumers; 57 out of a total of 355 Italian geographical indications will be protected; more than 1400 Italian companies are already active in the area; Italian exports to the area already stand at around 7.4 billion (2024 figure). The duties currently imposed on European products are not just a cost of entry but are often non-monetary and therefore linked to protectionist dynamics set up for specific sectors. With the signing of the agreement, these entry barriers will be eliminated, allowing European companies to increase their exports to the region.

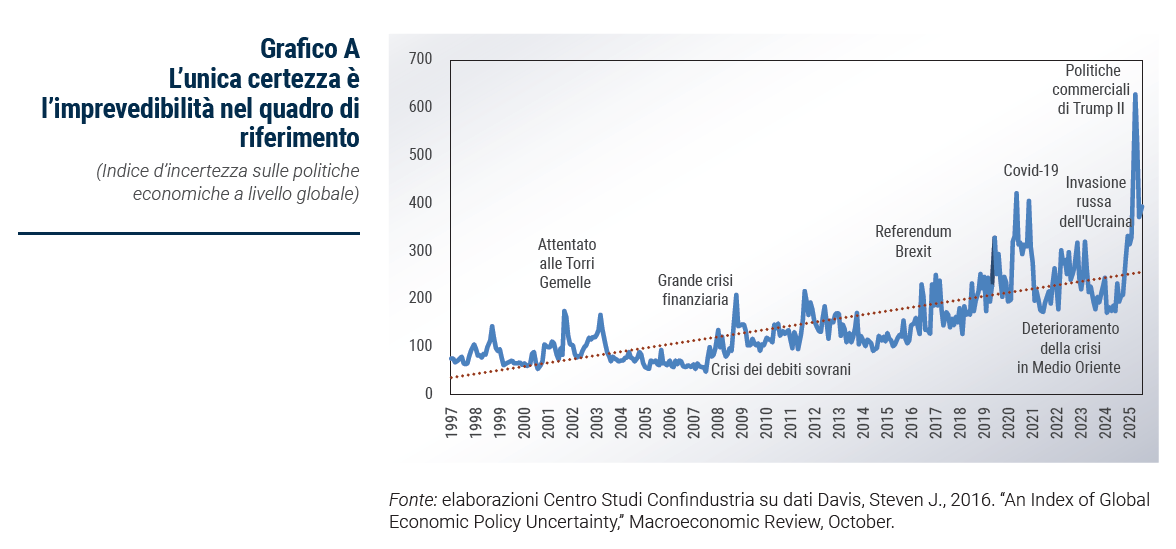

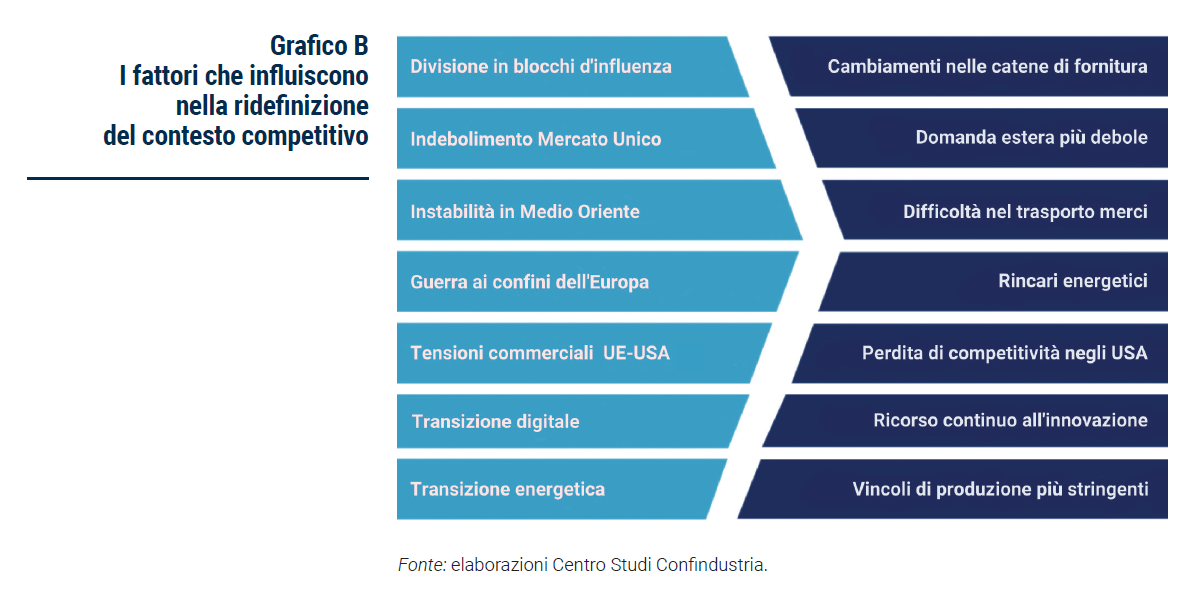

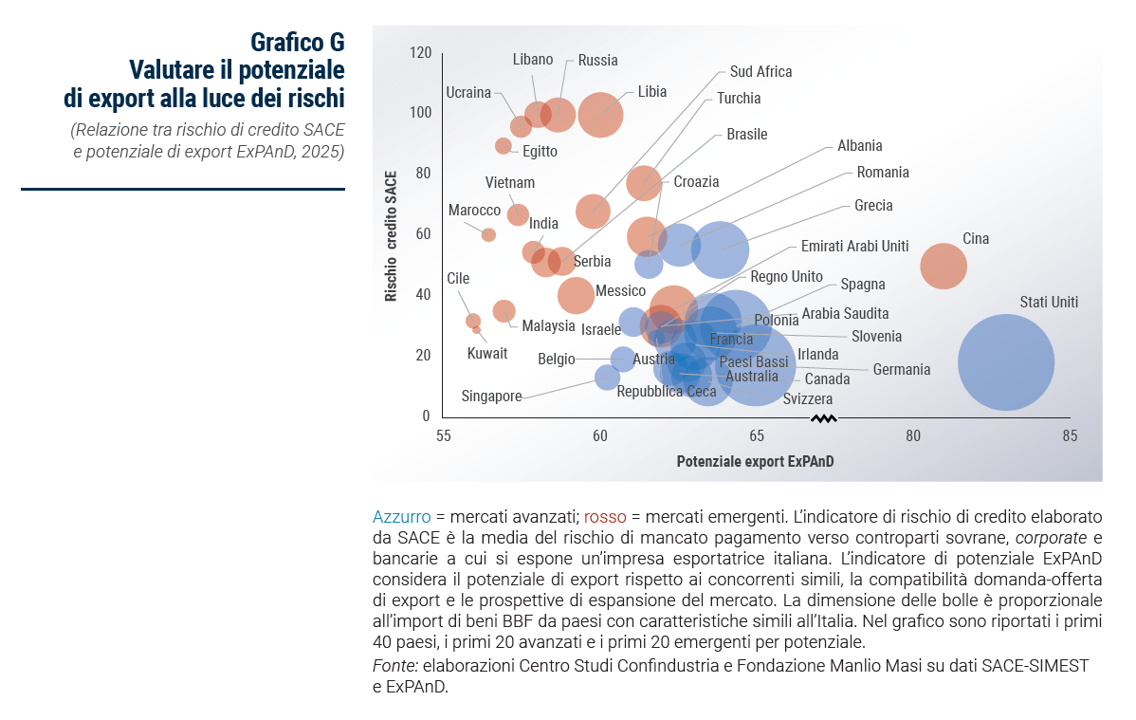

War is confirmed as the worst risk element globally International tensions related to the conflicts in Ukraine and the Middle East continue to deteriorate the global economic picture. Conflicts generate two types of effects: in the protagonist territories, economic activities come to a standstill (e.g. in the Ukraine); in the affected territories, collateral factors such as geopolitical divisions, sanctions, and business actions used for retaliatory purposes (e.g. with Russia) take over. These factors explain how geopolitical tensions and especially armed conflicts bring with them a deterioration in credit risk. To understand the implications of this, the analysis of potential is accompanied by an analysis of the risk posed by each market (Chart G). It is not surprising that Russia and Ukraine rank so high on the credit risk scale, being the two countries directly involved in the conflict along with Libya and Lebanon. The advanced countries remain rather safe, which, moreover, represent the most relevant destinations for BBF exports (bubble size indicative of additional growth margins for Italian exports), where the more structured economies are allowing for greater stability, despite the difficulties linked to trade tensions.

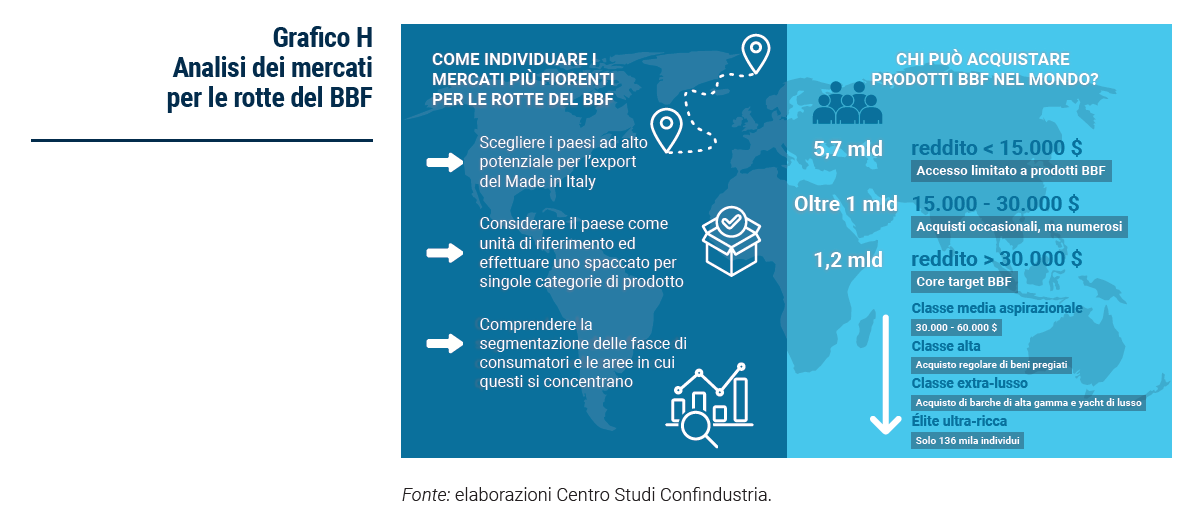

Identifying the most flourishing markets for BBF routes involves several levels of analysis The first step is to choose the countries that represent destinations to be considered high potential for Made in Italy exports. Considering the country as a unit of reference brings with it many advantages: in fact, homogeneous customs regulations coexist within it and, from an analytical point of view, a cross-section can be made by individual product categories. The analysis by countries, however, needs to be enriched with further information in order to understand both the segmentation of consumer groups (Chart H) and in which areas these are concentrated within them, especially in the case of very vast geographies that in terms of size are like veritable continents (e.g. the United States, China and India).

The BBF can count on more than 1.2 billion affluent or very wealthy people Of the more than 8 billion individuals in the world, 5.7 billion have rather low incomes, below $15,000. This segment of the population is unlikely to buy BBF products, but certainly should be given due attention in business strategies. There are more than one billion people with incomes between $15,000 and $30,000, who nonetheless constitute a slice of the market to be kept in mind for Italian companies because, although they make occasional purchases of Italian products, given their high numbers they generate significant sales flows and thus represent a springboard for the realisation of economies of scale, so that they can also serve wealthy segments of the population with higher margins. The remaining part of the world's population, over 1.2 billion people, is rightfully among the potential buyers of BBF goods. Being the clearest target for BBF sales, it is worth distinguishing within it several income brackets corresponding to population groups with heterogeneous consumption habits. Certainly, the aspirational middle class, with incomes between $30,000 and $60,000, is interested in all kinds of fashion-related purchases, be it clothing, footwear, eyewear or leather goods, but also taste and design, such as medium-high-end food and wine products or fine furniture. This segment of people tends to have good spending power in relation to a strong sense of quality, being able to fully distinguish and appreciate the distinctive features of BBF. As income rises, the number of possible customers decreases dramatically, but it becomes almost certain and more frequent to buy valuable if not exclusive luxury goods. Approximately 375 million people can buy high-end sailboats and just over 9 million luxury yachts. Within the billionaire bracket, the pinnacle is reached with a tiny class of population, 136,000 individuals worldwide, whose purchases tend to be more unique than exclusive, turning to dedicated suppliers, chefs, craftsmen and designers.

Within the countries, especially the larger ones, the most promising locations should be identified The United States, China and India have continental extensions that conceal strong heterogeneities in both population and wealth distribution. Given the vast potentials found at the aggregate level for each of these countries, it is then necessary to identify the main marketplaces within them, whether they represent states, provinces or cities: California, New York, Florida, Shanghai, Beijing, Zhiejiang, Gujarat, Marahastra, Kerala, Abu Dhabi, Dubai... what do all these geographies have in common? Most of them are highly urbanised centres often located along coastal areas, where the wealthier segments of the population are concentrated. The combination of information on location and information on segmentation by consumer groups within them is crucial for identifying the most promising markets.

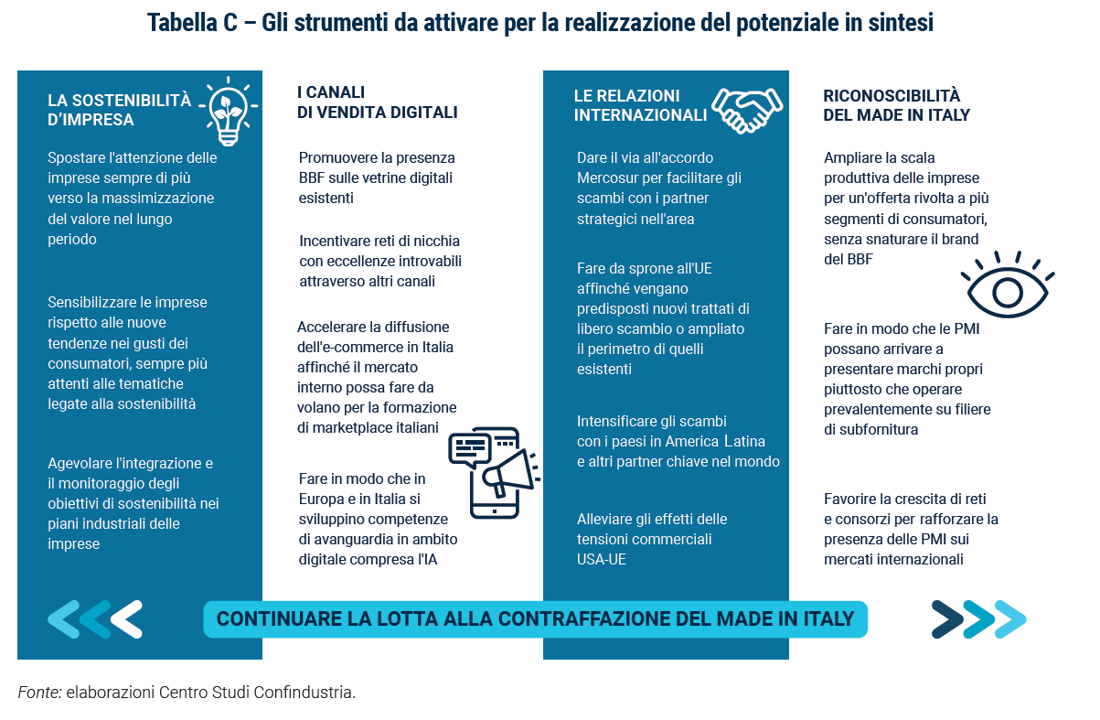

Realising the potential goes through capacity building and also depends on policy choices The fact that there is ample room for improvement for Italian exports does not mean that this is automatic. Increasing exports implies an increase in production upstream, which in turn implies an increase in investments. To this end, a coordinated effort by companies and institutions is required to encourage a generalised strengthening of the Italian production system and its competitiveness along several axes. While companies should commit themselves to allocating resources to productive investments, institutions should spur this process by mitigating the elements of uncertainty that condition companies' investment choices.

Expansion of the production scale and product diversification to serve all segments of the population within countries A key element of China's success in international markets has been to be able to produce and sell to all groups of buyers, the less affluent in the first place (those more than 5 billion individuals who have to rely on incomes below $15,000). This has been the driving force behind the creation of a broad logistics base for the transport of Made in China goods around the world, even to those countries that for the moment import very little from Italy or from countries with cost structures similar to its own. For Italian companies, the expansion and diversification of their production base can only be achieved through the massive use of robotics enhanced by artificial intelligence, given the gap in terms of the human factor compared to a giant like China, which is already vying for the leadership with the USA in the technological field.

Artificial intelligence (AI) will be central in all areas of production Strengthening digitisation is necessary not only to remain competitive in new technologies, but also to integrate AI into existing industries so that they can remain at the forefront in the decades to come. Misunderstandings must be cleared up from the outset: AI is now a structural factor in our socio-technical-economic system, which will be able to reduce cognitive inequalities because it is language-based and thus characterised by unparalleled ease of use. One has to get used to considering the adoption of AI in the same way as the introduction of electricity: to represent, on the one hand, its pervasive impact and, on the other, its potential transformative effect on the functioning dynamics of people, businesses and objects. The artificial intelligence market, in Italy, is growing substantially also because it is still moving on a very minimal scale.

Digital sales channels and BBF recognition remain the key tools to realise the potential In a world that is increasingly connected and where purchasing decisions are made predominantly online (even if the purchase then materially takes place in many cases in physical shops), strengthening digital sales and advertising channels, whether it means promoting the BBF's presence on existing channels or doing so on new ones, is vital. Not presiding over these virtual showcases would accumulate a competitive disadvantage that would be difficult, if not impossible, to overcome. Through these channels it is also possible to promote the creation of brands for small and medium-sized Italian companies. The recognisability of Made in Italy could also be enhanced by encouraging the creation of networks and consortia of companies aimed at extracting more relevance from global value chains and aimed at overcoming the undersize of Italian entrepreneurship in many sectors.

Trade agreements and revitalisation of multilateral bodies are lifeblood for Made in Italy The extraordinary performance of Italian exports around the world is also attributable to the numerous trade agreements that Europe, and consequently Italy, has signed over the years. The finalisation of new agreements (first and foremost the above-mentioned EU-Mercosur agreement) and the halting weakening of EU-US ties can contribute to the stabilisation of international relations that Italy cannot do without in order to cope with growing competition. The integration of markets facilitates trade, and this has been happening in Asia for some time: direct testimony to this is the creation of the world's largest trading area, the Regional Comprehensive Economic Partnership (RCEP). Equally fundamental to BBF export performance are the Free Trade Agreements (FTAs) that help Italian companies overcome tariff and non-tariff barriers. Finally, in countries with which there are no FTAs with the EU, it is important to pragmatically pursue a bilateral dialogue to overcome market access barriers and obstacles, contributing to the revitalisation of multilateral bodies in order to have clear and certain approaches on trade rules, the World Trade Organisation in primis.

Sustainability remains central in the pursuit of potential Many Italian companies have already initiated a profound change in the design and manufacturing processes aimed at making the products that leave their factories more sustainable. In fact, it is no longer sufficient for companies to aim at profit maximisation, but it is necessary for them to become aware of the impact of their choices on the environment and thus improve the management of resources (natural, financial and human) without ever exploiting them so intensively as to compromise the well-being of present and future generations. Basically, it will be, and already is, the task of companies to pursue value maximisation in the long run. Although it will take time, this strategy can only prove to be more cost-effective and far-sighted in securing gradually increasing market shares. Indeed, consumer interest in sustainability is no longer a negligible factor. In order to win new market shares and secure the loyalty of buyers, the degree of sustainability of the products sold cannot be hidden. Indeed, the portion of consumers who take sustainability into account in their purchasing choices is dominant. Moreover, it would be a serious mistake to consider this phenomenon as temporary, as this trend does not seem to have been challenged even by the most serious economic turmoil in recent years.

The BBF between counterfeiting and Italian sounding The quality of Italian products and their excellent reputation throughout the world make them the object of imitation. The appeal to the Made in Italy aesthetic allows higher selling prices without reflecting their intrinsic value due to the poor quality of the materials and sloppy workmanship. The high loss of market share due to counterfeiting makes it urgent to take action against it. Italian products must then be protected against another equally damaging but legal phenomenon, in contrast to counterfeiting, namely Italian sounding. This consists in evoking the idea of the quality of Italian products on labels and packaging through the use, without actually falling into illegal practices, of names, geographical references, images, colour combinations and the reproduction of trademarks similar to the originals. The consequences of these practices are particularly harmful and represent one of the greatest obstacles to the full potential of Made in Italy food products. Actions that can be taken to mitigate the problem range from strengthening the protection of geographical indications within free trade agreements, to the use of more effective marketing campaigns to help recognise the Made in Italy brand (Table C).