menu start: Fri Apr 19 02:37:30 CEST 2024

menu end: Fri Apr 19 02:37:30 CEST 2024

menu start: Fri Apr 19 02:37:30 CEST 2024

menu end: Fri Apr 19 02:37:30 CEST 2024

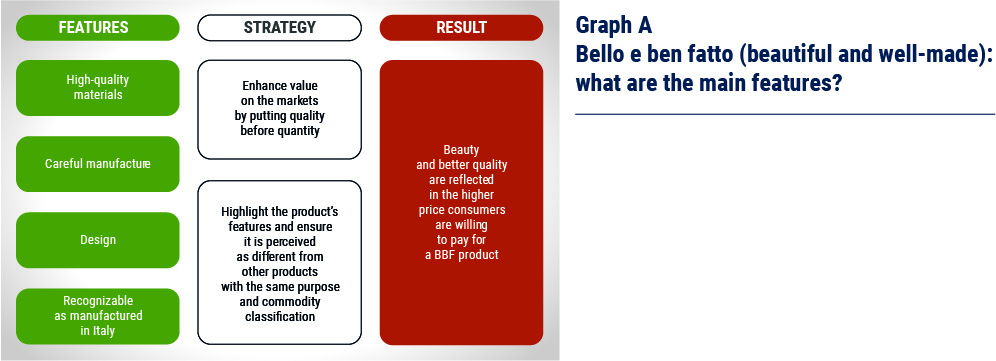

BBF (bello e ben fatto, literally translated as beautiful and well-made) embraces all those products that exemplify Italian excellence in terms of design, attention to detail, high-quality materials and careful manufacture. Such goods exist in all branches of production, but the majority of them can be found in sectors more closely linked to aesthetics and creativity. In this respect, BBF is the most recognisable expression of the Made in Italy brand, encapsulating the best-known features of the Italy’s cultural heritage, traditions, landscapes and works of art and helping to build animage of Italian manufacture (Graph A).

In this respect, BBF products not only represent a large share of Italy’s world exports, they also drive all Italian exports as their value goes way beyond the purely economic.

Italy is among the top 10 in the global ranking of ex-porting countries, coming in seventh place. Its position improves considerably if we look only at the ranking for consumer goods, where Italy comes third after China and Germany. This position applies to a highly diversified basket of goods: Italy comes at the very top in terms of balanced distribution of exports among the various products.

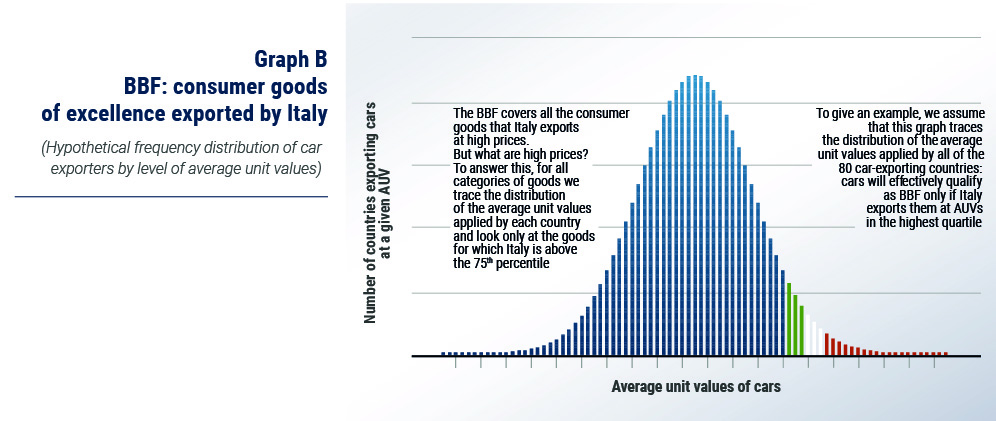

This is largely attributable to BBF products, which incorporate all the consum-er goods of excellence that Italy is able to export at high prices (Graph B).

Generally, the new emerging economies’ participation in world trade (and first and foremost that of China) has magnified both the scale and the volume of production of many of the goods traditionally manufactured by Italian firms, initially in the food, textile and footwear sectors, but subsequently also in sectors requiring more complex production processes and linked to longer production chains. This has led to increasingly fierce competition on international markets, forcing Italian firms to adopt new productive and commercial strategies.

Over the years, Italian manufacturing has succeeded in realising an overall quality upgrade that has allowed it to avoid price competition from the emerg-ing economies and focus increasingly on the supply of goods with higher value added. The results obtained by BBF products are the outcome of this process, which has progressively increased the range of goods in the upper segment of the market.

BBF products represent 15.6 per cent (2018, last available figure) of Italy’s total exports and are spread across all the main sec-tors of Made in Italy, although predominantly in the so-called three-Fs – Fash-ion, Food and Furniture. Italian products of excellence go mainly to advanced markets, which overall take up some three quarters of them, equivalent to just under €70 billion.

The remaining quarter is exported to the emerging coun-tries, which owing to their rapid growth (both demographic and economic) and despite their still lower weight, offer relatively greater scope for expan-sion, even though the risks remain higher.

The study set out in the Report allows us to obtain a measure of Italy’s export un-tapped potential for BBF products against which we can evaluate the scope for improving the current position. This potential is calculated by estimating how much current market shares could increase with respect to those of competitors similar to Italy as regards production cost structure and product quality.

What protects BBF products against fierce price competition (consider the impact of Chinese exports) is their distinctive quali-ty, which puts them in a separate market with respect to other goods officially grouped in the same commodity categories. Many BBF products are in a mar-ket of their own, reserved to segments where there are very few competitors, mostly in advanced countries with similar cost structures to Italy. In this re-spect, the BBF products that Italy exports (which typically target sophisticated consumers, focus on quality, and convey an emotional value) are competing with those produced by the most developed competitors, operating in niches that are protected from countries with lower costs.

The first have larger markets and greater demand for BBF products (they have higher per capita income). Demographic and economic trends in the mature economies of the advanced countries evolve relatively slowly and so the way to achieve growth is by trying to poach market shares from competitors or at the very least by holding on to existing shares: with large volumes, even low growth rates may offer a chance of significant expansion, especially for small and medium-sized firms. Although the emerging markets are on aver-age smaller in terms of economic size (apart from China and India), they are growing at a faster pace and they offer Italy greater potential to increase its exports (they are less saturated with Italian exports than with the exports of competitors like Germany and France).

The way to achieve the potential for export growth is through commercial penetration of the countries and sectors with the greatest scope for expansion. This is a game to be played on several boards at once, with different opponents depending on the geographical areas and sectors concerned. The aim of this Report is to provide an overview of the ones worth taking on and the type of competition encountered there.

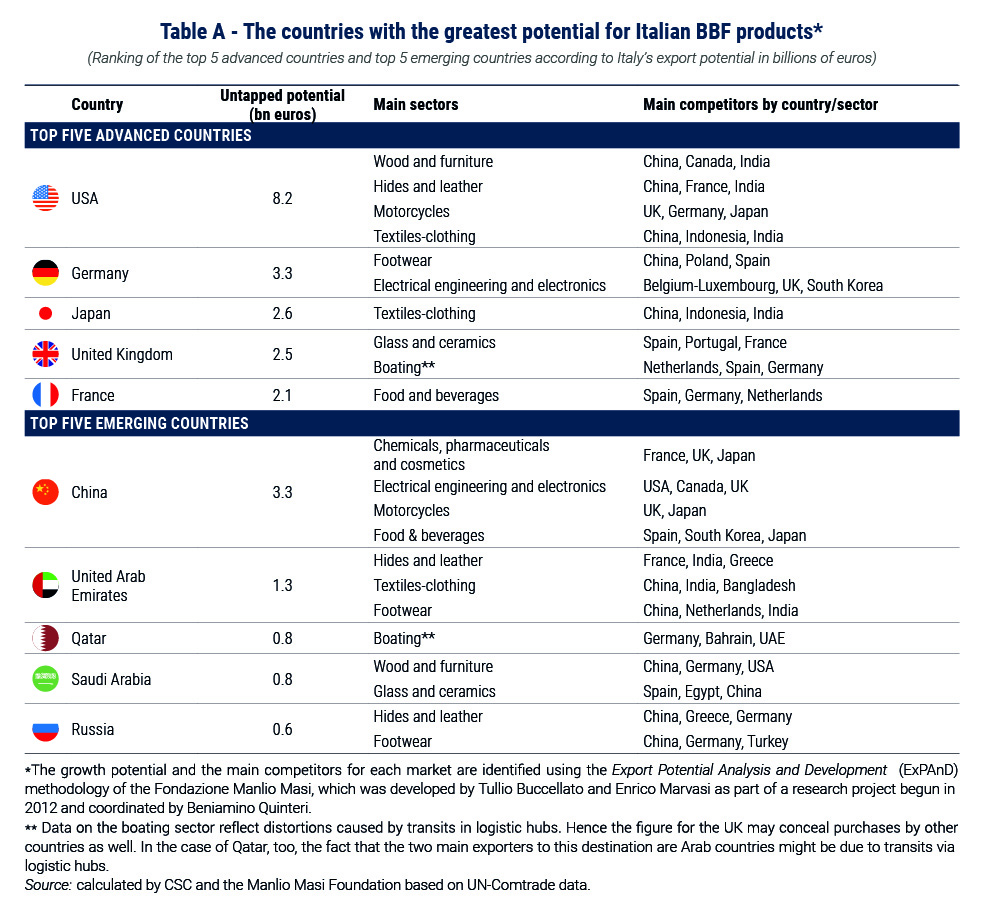

Table A illustrates, for the top five advanced countries and the top five emerg-ing countries in terms of export potential, which sectors are the most import-ant, which countries are Italy’s main competitors in those particular markets, and what factors determine the amount of export potential (specifically: size of margin to be exploited compared with existing level, market growth, compati-bility of demand structure in the destination markets with supply structure of Italian BBF products).

The driver of exports in the advanced countries is the notable presence of shared tastes and standards, reflecting very similar cultural contexts. These are also the main countries with which Italy has economic, political and strategic relations, and hence particularly close geo-economic ties. The most importantcountries are the United States (€8.2 billion), Germany (€3.3 billion) and Ja-pan (€2.6 billion). Among the emerging economies, the main markets are China (€3.3 billion), the United Arab Emirates (€1.3 billion), Qatar (€0.8 billion), Saudi Arabia (€0.8 billion) and Russia (€0.6 billion).

The United States, China and Ger-many are without doubt the leading markets for export opportunities, but for different reasons: China because of its size and growth, Germany because of the compatibility between demand and supply, and the US owing to a balanced combination of both factors. The margin for improvement in exports to Japan, which is large in absolute terms, is offset by the fairly limited growth prospects of import demand.

This shows the countries that are of particular interest, not so much because of the size of the margin for export growth as because the market is expanding rapidly.

This is the case of India (€0.2 billion of potential exports), to which Italy exports relatively little and whose size and outlook for growth set it among the most interesting markets. Russia, too, given its size and above all the compatibility between demand and supply, offers significant export opportunities.

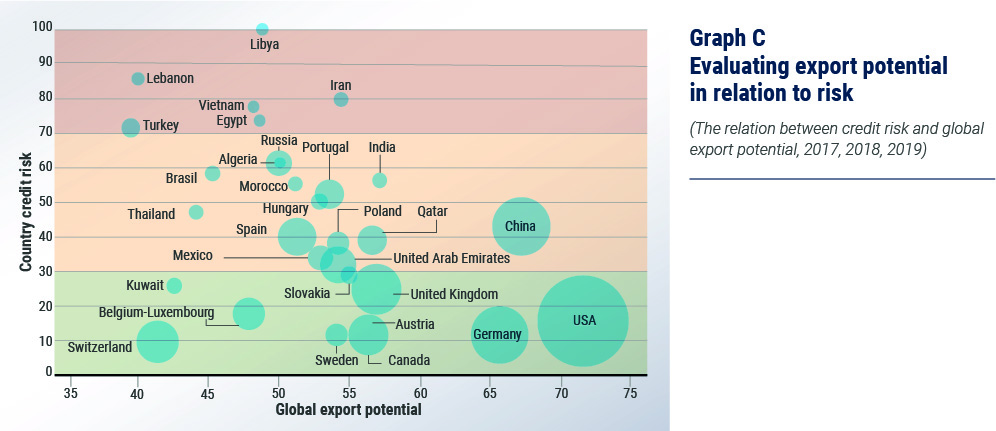

The analysis of export potential is accompanied by an analysis of the risk that each market presents (Graph C). Clearly, this type of representa-tion (risk-potential) aims to offer a simple interpretation of the results, and in a complex world it is important to avoid drawing clear-cut conclusions. First, the averages are the outcome of a variety of information. For example, while there may be certain types of risks and opportunities at the aggregate level, some partners or sectors could move against the trend. Consider China, which offers a high degree of reliability as a sovereign partner, but increased risk in the case of transactions with banks and non-financial companies because of their notoriously high debt level. A similar argument applies to Russia, where very sound public finances contrast with the possibility of problems in some corporate sectors and in the banking industry. There are other emerging coun-tries that are important trade partners of Italy, such as Brazil and India, whose macro-economic fundamentals indicate that they are unlikely to experience the crises that overtook Argentina and Turkey in 2018, but which on the other hand need to be approached with caution. In Argentina, for example, the public debt has ballooned recently and economic growth is still weak, with all that this en-tails for business. In India, the banking system is experiencing problems owing to the increase in accumulated bad debts in recent years. Yet both markets are still strongly protected. The economic situation in other major destinations for Made in Italy products is fairly negative for a variety of reasons (Iran and Turkey): it will be some time before they once again offer greater export po-tential and less risk. The global situation is in constant flux, with the result that the outlook for some countries and sectors may change rapidly. The group of advanced countries that represent the most promising outlets for Italian BBF exports is also the group presenting the least risk.

Increasing protectionist tendencies threatens to harm many BBF sec-tors and reduce their potential export growth in many markets, first and fore-most the US. A worrying symptom is the recent introduction of customs duties following the WTO’s ruling, which threatens to trigger various forms of retalia-tion, with unforeseeable consequences. Although for now Italy is not among the worst affected countries, some products linked to the BBF sector have already been affected (for instance, Parmesan and other cheeses, citrus fruit, salami and cured meats and spirits will be subject to 25 per cent duty).

At a time of bitter trade tensions, Europe’s response has been unequivocal, as reflected in the words of, among others, Cecilia Malmström, former European Commissioner for Trade, when she said ‘there is no protection in protectionism’. The trade agreements signed by the EU in recent years have successfully encouraged firms (European and Italian) to enter strategic markets.

Agreements have a positive effect on trade, especially for small and medium-sized firms, which benefit most from their impact in terms of simplifying entry into markets and lowering production costs.

Although Italy is among the top ten countries for online sales, it lags farthest behind its main competitors (which are also its main markets). In terms of percentage of GDP, Italy (at 17 per cent) is closer to China (16 per cent) and India (15 per cent) than to the other advanced countries, which range from South Korea’s 84 per cent to France’s 28 per cent. BBF products need to be displayed in dedicated virtual marketplaces that highlight the features that distinguish them from similar, but not excellent, goods and, more importantly, from counterfeits. Milan Polytechnic’s observatory on e-commerce has underlined that the largest online sales are in the food and clothing sectors, two of the threeFs, which are the pillars of BBF. The challenge is both huge and unavoidable.

Imitations are often found among non-BBF products, counterfeits that fraudulently exploit the brand name and customer loyalty of some makes of goods. The counterfeit industry has become massive, particularly in Italy’s BBF sectors. Italian products are among those most in demand worldwide, partly thanks to the attraction of the Made in Italy brand, and therefore they are among the most frequently imitated. A particularly worrying trend is that of sound-alikes and look-alikes of Italian products: imitations, notably in the agri-food sector, whose name or packaging has Italian connotations. This practice, which debases the image of product quality and tricks less attentive consumers into thinking they are buying an original Italian product, causes the BBF sector to lose market shares (and damages its image). BBF counterfeiting not only causes material damage to Italian firms, it also makes it more difficult to measure the BBF phenomenon and undermines some of the relative statistics; it is possible that Italy’s shares are distorted downward.